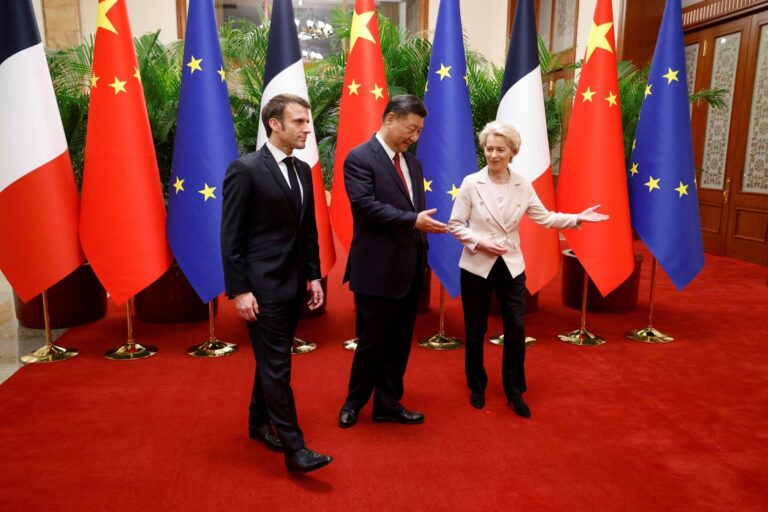

In the complex landscape of global finance, the specter of sovereign credit downgrades looms large, especially as geopolitical tensions and economic uncertainties mount. A prominent French agency is taking proactive measures to mitigate these risks through a strategy termed “decoupling.” As investors and analysts alike assess the implications of this approach, the agency’s efforts come at a crucial time when visibility into creditworthiness is increasingly clouded. In this article, we explore the intricacies of this decoupling strategy, the motivations behind it, and its potential impact on sovereign ratings in the face of looming threats.

Impact of Decoupling on French Sovereign Ratings

The recent trend of risk decoupling among global economies poses significant challenges for France’s sovereign ratings. Analysts argue that the disconnect between French economic performance and broader European market conditions could exacerbate vulnerabilities. Key concerns include:

- Economic Isolation: A potential shift in trade dynamics may weaken France’s economic ties with other nations.

- Increased Borrowing Costs: Declining investor confidence could lead to higher interest rates, complicating fiscal management.

- Structural Reforms Delayed: Political resistance may hinder necessary reforms, impacting growth potential.

As agencies review their ratings, the impact of decoupling could shift focus from traditional metrics to more nuanced signals, such as market sentiment and geopolitical stability. This evolving landscape might prompt a reassessment of risk, with potential implications such as:

- Classifying France as a higher-risk borrower, which may influence investment flows.

- A series of downgrades for related financial instruments, increasing costs across the board.

- A potential ripple effect in the Eurozone, affecting neighboring countries tied to French economic performance.

Analyzing the Risk Factors Behind Potential Downgrades

The looming threat of sovereign downgrades, as highlighted by the recent discussions from a French agency, underscores multifaceted risk factors that could destabilize national credit ratings. Among these factors are economic volatility, political instability, and shifts in global market dynamics. The interconnected nature of today’s economies means that external shocks, such as spikes in inflation or geopolitical tensions, can have ripple effects, making it crucial for stakeholders to monitor these influences closely. Additionally, domestic policies addressing fiscal sustainability and structural reforms will play a decisive role in maintaining investor confidence.

Furthermore, investors are increasingly vigilant about the implications of a potential “decoupling” in international relations, particularly between major economies. This strategy could lead to fragmented trade partnerships and increased uncertainty within financial markets. Key indicators that could foreshadow a downgrade include:

- Debt-to-GDP Ratio: A significant rise may indicate fiscal irresponsibility.

- Political Turmoil: Frequent changes in government could weaken economic policies.

- Trade Dependencies: Over-reliance on a single economy can create vulnerabilities.

To illustrate these risks further, the table below summarizes recent trends in key economic indicators for France and their relation to potential sovereign downgrade risks:

| Indicator | Current Value | Trend |

|---|---|---|

| Debt-to-GDP Ratio | 115% | ⬆️ |

| Political Stability Index | 0.32 | ⬇️ |

| Trade Balance (in billion EUR) | -25 | ➡️ |

As these indicators illustrate, the combination of rising debt levels, political challenges, and a persistent trade deficit heightens the risk profile, casting shadows over France’s sovereign credit ratings in the near term.

Strategies for Investors to Navigate Market Uncertainty

As market volatility escalates, investors must adopt proactive measures to safeguard their portfolios. Diversification remains a cornerstone strategy; spreading investments across various asset classes can mitigate risk associated with any single economic downturn. Additionally, pivoting towards defensive sectors, such as utilities and consumer staples, can provide stability during turbulent periods. Investors should also consider reallocating capital into international markets that may be less affected by domestic uncertainties, thereby fostering a more resilient investment strategy.

In response to the looming threat of sovereign downgrades, investors are urged to closely monitor credit ratings and economic indicators. Establishing a regular review process for investments can identify potential weaknesses in portfolio performance. Furthermore, implementing hedging techniques, such as options and futures contracts, can safeguard against adverse market movements. Regular communication with financial advisors can also ensure informed decision-making, enabling investors to navigate these challenges more effectively.

Recommendations for Policymakers to Mitigate Financial Risks

In response to the rising concerns of financial instability and the potential for sovereign downgrade, policymakers must adopt a proactive approach to mitigate risks. Diversifying funding sources will be crucial; this can be achieved by encouraging public-private partnerships and tapping into alternative financial markets. Strengthening regulatory frameworks that govern the financial sector can help enhance resilience against shocks. Specific measures might include increasing capital requirements for banks and enhancing stress testing protocols to ensure institutions are better prepared for adverse situations.

Furthermore, fostering informed decision-making among financial decision-makers is essential. This could involve establishing a centralized risk management body to monitor and analyze evolving market dynamics. To support these initiatives, a comprehensive communication strategy is necessary to ensure transparency and build public trust. Consider implementing regular advisory sessions for stakeholders, which could include:

- Workshops on risk assessment tools

- Quarterly risk exposure updates

- Collaborative platforms for data sharing

Such strategies will not only safeguard national financial interests but also bolster investor confidence in the long run.

To Conclude

In conclusion, the actions of the French agency to promote risk decoupling highlight a strategic response to the mounting pressures of potential sovereign downgrades. As market volatility increases and economic uncertainties loom, the agency’s proactive measures may offer a roadmap for navigating the complexities of an ever-evolving financial landscape. Stakeholders and investors alike will be closely monitoring these developments, as the implications of decoupling could resonate across the broader European financial system. As the situation unfolds, the focus will undoubtedly remain on how effectively these strategies can mitigate risks and enhance economic stability amidst growing challenges.