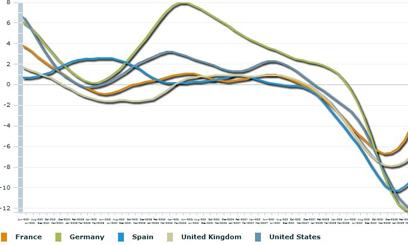

The France Business Climate Indicator has dropped to a three-month low, signaling growing concerns about the countryŌĆÖs economic outlook. According to the latest data reported on TradingView, this decline reflects mounting uncertainties among French businesses amid ongoing global challenges. Analysts are closely monitoring the trend as it may have significant implications for investor confidence and economic policy in France.

France Business Climate Suffers Steep Decline Reflecting Economic Uncertainty

Recent data reveals a significant drop in the economic sentiment among French businesses, marking the lowest point in three months. This sharp decline signals growing unease over factors including inflationary pressure, stagnant consumer spending, and geopolitical tensions impacting supply chains. Industry leaders have expressed concerns that these elements are collectively stifling growth prospects, forcing many companies to adopt conservative forecasts for the near term.

Key contributors to the weakening business climate include:

- Rising energy costs significantly eating into operational budgets

- Labor market rigidity hindering recruitment and wage adjustments

- Global trade uncertainties affecting export-dependent sectors

Below is a summary of the latest business sentiment indicators:

| Sector | Sentiment Change (MoM) | Current Index Level |

|---|---|---|

| Manufacturing | -4.2% | 95.6 |

| Services | -3.5% | 92.3 |

| Retail | -5.1% | 89.7 |

Key Sectors Driving the Downturn and Their Market Implications

The recent slump in FranceŌĆÖs business climate is notably influenced by a contraction in several pivotal sectors. Manufacturing has experienced a sharp decline, primarily due to disrupted supply chains and waning demand from key export markets. Similarly, the construction sector shows signs of stagnation, hindered by rising material costs and labor shortages, which have delayed numerous projects nationwide. Retail and consumer goods, once buoyed by surging domestic spending, are now grappling with inflationary pressures that dampen consumer confidence and reduce discretionary expenditures.

Market ramifications are tangible, with investor sentiment growing cautious across equities linked to these sectors. The financial services industry, closely tied to the health of manufacturing and construction, reports a tightening in credit conditions as risk assessments become more conservative. Below is a snapshot of the core sectors and their recent performance metrics reflecting this downturn:

| Sector | Q1 Performance | Market Impact | Sentiment |

|---|---|---|---|

| Manufacturing | -6.8% | Export slowdowns | Negative |

| Construction | -4.3% | Project delays | Bearish |

| Retail & Consumer Goods | -2.7% | Reduced spending | Neutral to Negative |

| Financial Services | -1.5% | Credit tightening | Cautious |

- Manufacturing: Key driver of export revenue now strained by external demand factors.

- Construction: Faced with input cost inflation and workforce shortages impacting growth.

- Retail: Consumer retrenchment amid cost-of-living pressures.

- Financial Sector: Risk-averse lending environment affecting capital availability.

Government and Industry Responses to Revive Business Confidence

In a bid to stabilize the faltering economic landscape, French policymakers have unveiled a series of targeted stimulus measures aimed at rejuvenating business activity. Key initiatives include tax relief for SMEs, subsidies to foster green technologies, and the acceleration of digital transformation grants. These interventions are designed to ease operational costs and encourage investment, signaling a proactive approach to reverse the declining business sentiment that has gripped the market over the past quarter.

Industry leaders have responded with cautious optimism, emphasizing collaboration with government bodies to optimize these new policies. Efforts to boost workforce training and innovation are underway, with several sectors prioritizing sustainable growth models. The table below highlights some of the most impactful responses, illustrating the dynamic interplay between public policy and private sector resilience:

| Sector | Government Support | Industry Action |

|---|---|---|

| Manufacturing | Low-interest loans | Automation upgrades |

| Technology | R&D tax credits | Talent recruitment |

| Renewables | Investment subsidies | Expansion of solar projects |

Strategic Recommendations for Investors Navigating Current Market Conditions

Investors should consider diversifying portfolios to mitigate the impact of the current downturn in France’s business climate indicator. Emphasizing sectors with counter-cyclical characteristics, such as healthcare and consumer staples, can provide stability amid uncertainty. Additionally, exploring international markets with stronger growth prospects could offset localized weaknesses, especially within the Eurozone. Staying agile by monitoring economic data releases and adapting investment strategies accordingly will be paramount in navigating the evolving landscape.

Risk management must be enhanced through the use of tactical asset allocation strategies. Utilizing hedging instruments like options and inverse ETFs can help protect gains during periods of heightened volatility. Moreover, investors should place particular focus on companies demonstrating robust balance sheets and resilient cash flows, which are better positioned to weather economic contractions. Below is a quick reference table highlighting key sectors and recommended approaches in the current environment:

| Sector | Recommended Strategy | Risk Level |

|---|---|---|

| Healthcare | Increase Exposure | Low |

| Technology | Selective Investment | Medium |

| Energy | Hedge Positions | High |

| Consumer Staples | Maintain Current Levels | Low |

In Retrospect

In conclusion, the latest data revealing FranceŌĆÖs Business Climate Indicator at a three-month low underscores mounting concerns about the countryŌĆÖs economic trajectory amidst global uncertainties. Market participants and policymakers alike will be closely monitoring upcoming economic releases and government responses to gauge the potential for a rebound or further contraction. As businesses recalibrate their strategies, the evolving climate will remain a critical barometer for investors and analysts tracking FranceŌĆÖs economic health in the months ahead.