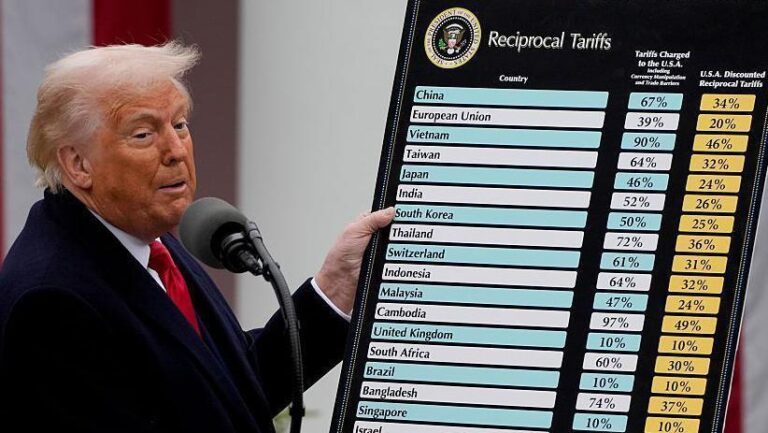

As fears mount over the potential impact of U.S. tariffs imposed by the Trump administration, FranceŌĆÖs iconic Champagne region finds itself on edge. Wine producers and exporters worry that escalating trade tensions could disrupt their lucrative access to the American market, a vital destination for their sparkling wines. This developing story highlights the broader economic and diplomatic ripples generated by tariff policies, with the Champagne industry standing as a focal point of concern in transatlantic trade relations.

TrumpŌĆÖs Tariffs Threaten Export Stability for Champagne Producers

The imposition of tariffs on French goods by the Trump administration has sent shockwaves through the Champagne region, casting uncertainty over one of FranceŌĆÖs most prestigious export markets. Local producers, whose livelihoods hinge on stable access to international buyers, now face escalating costs that could render their products less competitive in the United States ŌĆö a crucial destination for nearly 20% of their exports. Industry leaders warn that sustained tariffs may prompt buyers to seek alternative luxury beverages, potentially disrupting long-established trade relations.

Champagne houses are scrambling to adapt amid fears of prolonged economic fallout. Key concerns include:

- Increased production costs: Tariffs could push retail prices higher, squeezing margins.

- Market volatility: Uncertainty risks dampening consumer confidence and demand.

- Long-term trade instability: Potential retaliation and shifting policies may further complicate exports.

| Export Destination | Percentage of Total Export | Tariff Impact |

|---|---|---|

| United States | 19.7% | High |

| United Kingdom | 14.2% | Low |

| Germany | 12.6% | Moderate |

Economic Uncertainty Sends Shockwaves Through Small Vineyards and Growers

The looming threat of tariffs proposed by the Trump administration has unsettled many small vineyards and growers throughout FranceŌĆÖs Champagne region. These businesses, often family-owned and operating on thin margins, face the potential loss of critical export markets in the United States, which accounts for a significant portion of their annual sales. The uncertainty has already led to a cautious approach in investment, with many producers delaying equipment upgrades and expansion plans as they weigh the long-term impact of trade disruptions.

Industry experts highlight several immediate challenges these growers encounter:

- Price Volatility: Tariffs could increase export costs by up to 25%, forcing producers to either reduce profit margins or pass on higher prices to consumers.

- Supply Chain Risks: Export delays and increased paperwork may disrupt established distribution networks, threatening timely deliveries.

- Market Contraction: Potential loss of U.S. market share risks declining demand, which could destabilize small producers reliant on bulk sales.

| Factor | Potential Impact | Grower Response |

|---|---|---|

| Tariff Increase | +25% Cost on Exports | Price adjustments, explore new markets |

| Export Delays | Delivery Uncertainty | Strengthen logistics partnerships |

| Demand Fluctuations | Reduced Sales Volume | Focus on direct-to-consumer sales |

Industry Leaders Call for Strategic Diversification Amid Trade Tensions

As trade tensions escalate, leading figures in the champagne industry are advocating for a tailored approach to safeguard their centuries-old craft. The looming threat of increased tariffs has prompted producers to explore new markets and diversify supply chains, mitigating risks associated with over-reliance on traditional export destinations. Industry insiders emphasize the urgent need for innovation and flexibility to sustain growth in a rapidly shifting geopolitical climate.

Key strategies highlighted include:

- Expanding presence in non-tariff impacted regions, such as Asia and the Middle East.

- Investing in local partnerships to navigate complex trade regulations more effectively.

- Enhancing production efficiency to offset possible cost increases caused by tariffs.

| Strategy | Expected Impact | Timeframe |

|---|---|---|

| Market Diversification | Reduced dependence on US exports | 1-3 years |

| Local Partnerships | Improved regulatory compliance | 6-12 months |

| Production Efficiency | Cost containment | Ongoing |

Government and Trade Groups Urged to Enhance Support for Champagne Exports

Faced with mounting anxiety over potential tariff escalations imposed by the United States, key stakeholders in the Champagne industry are pressing government bodies and trade organizations to intensify their support for exports. Industry leaders argue that strategic interventions are essential not only to sustain market access but also to ensure that France’s prestigious bubbles remain competitive on the global stage. In recent discussions, calls for enhanced promotional campaigns, streamlined export procedures, and increased diplomatic engagement have been prioritized to mitigate the looming risk posed by protectionist trade policies.

Proposed Measures to Fortify Champagne Export Resilience:

- Allocation of additional funding for international marketing and brand positioning

- Improvement of customs and logistics frameworks to reduce export delays

- Lobbying efforts aimed at preserving favorable trade agreements with key partners

- Collaboration with U.S. importers to build joint advocacy platforms

| Support Area | Expected Impact | Timeline |

|---|---|---|

| Marketing Initiatives | Boost Demand by 15% | 6-12 Months |

| Export Simplification | Reduce Delays by 20% | 3-6 Months |

| Trade Agreement Advocacy | Secure Tariff Exemptions | 12-18 Months |

Concluding Remarks

As the uncertainty surrounding U.S. trade policies continues, the Champagne region remains on edge, grappling with potential economic disruptions that could reshape its iconic industry. Stakeholders from vineyard owners to exporters are watching closely, hoping for clarity amid the tariffsŌĆÖ looming shadow. The unfolding situation underscores the intricate ties between global trade dynamics and local economies, with the Champagne region poised as a poignant example of the risks faced when geopolitical decisions ripple through centuries-old traditions.