In a development that underscores ongoing economic pressures, France’s preliminary inflation rate for July has been reported at 0.9%, slightly exceeding analysts’ forecasts. According to a recent Reuters report, this uptick reflects persistent price increases in key sectors, raising concerns about the broader implications for purchasing power and consumer confidence. As inflationary trends evolve, policymakers and economists are closely monitoring the situation, seeking to gauge the potential impacts on the French economy and the European region as a whole. With inflation figures continuing to sway economic forecasts, stakeholders are bracing for potential shifts in monetary policy aimed at stabilizing the market.

French Inflation Peaks at 0.9% in July, Exceeding Market Projections

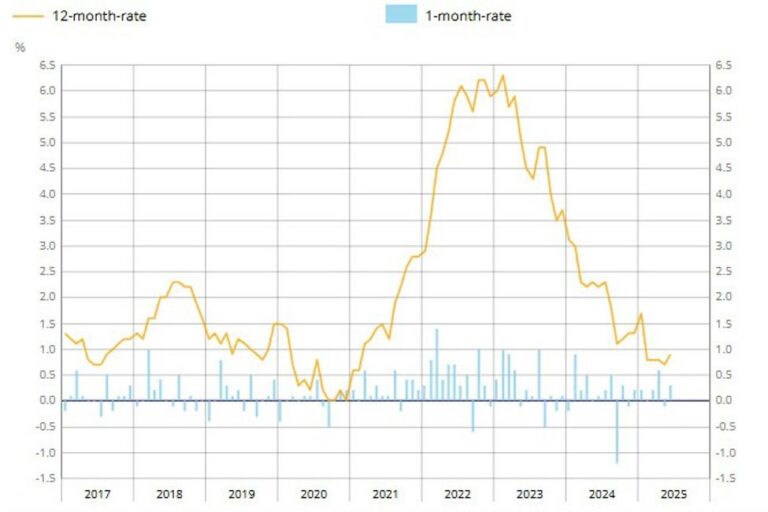

In July, France’s inflation rate surged to 0.9%, marking a noticeable increase that surpasses analyst expectations. This rise is attributed to a combination of factors, including fluctuations in energy prices and the ongoing adjustments in consumer goods costs. The increase is significant as it continues to challenge the economic stability that citizens have come to expect amid a recovering post-pandemic landscape. Analysts had previously estimated a more modest inflation rate of around 0.7%, making this uptick particularly noteworthy.

The impact of rising inflation is already being felt across several sectors, influencing spending habits and leading to increased prices in various everyday essentials. Key contributors to this inflationary trend include:

- Energy Costs: A rebound in global oil prices has reflected in local fuel costs.

- Food Prices: Agricultural supply chain disruptions are pushing food prices higher.

- Consumer Goods: Increased demand is putting pressure on manufacturers.

As the European Central Bank evaluates monetary policies in response to these inflationary pressures, it remains to be seen how government authorities will tackle the challenges posed by sustained price increases. Market observers are keenly watching for further shifts in economic indicators that may influence policy decisions in the coming months.

Economic Implications of Rising Inflation on Consumer Spending

The recent report from France indicating a preliminary inflation rate of 0.9% in July has raised concerns regarding the ongoing economic climate and its effects on consumer behavior. The uptick, which slightly surpassed expectations, signals potential shifts in spending patterns as households grapple with rising prices. As inflation erodes purchasing power, consumers may prioritize essential goods over discretionary spending. Analysts warn that this precarious situation may lead to altered habits in various sectors, particularly in retail and hospitality.

Experts predict the following potential consequences of sustained inflation on consumer spending:

- Reduced Discretionary Spending: Households may cut back on non-essential items, affecting sectors such as travel, dining, and luxury goods.

- Increased Demand for Discounts: Price-conscious consumers may shift towards discount retailers and promotions, impacting traditional retailers’ margins.

- Shift in Product Preferences: There may be a noticeable trend towards more affordable or generic brands as consumers seek to maximize their budgets.

| Category | Impact on Spending |

|---|---|

| Essentials | Stable or Slight Increase |

| Discretionary | Decrease |

| Luxury Goods | Significant Decrease |

Analysts Weigh In on Future Inflation Trends and Central Bank Responses

In a recent analysis, financial experts are closely monitoring the implications of France’s preliminary inflation reading of 0.9% in July, which slightly surpasses earlier forecasts. This uptick is raising concerns regarding meritocratic price pressures that could compel the central bank to reconsider its current policy framework. Analysts suggest that various sectors are experiencing distinct inflationary trends, driven by factors such as rising energy costs and supply chain disruptions. Key insights include:

- Energy Market Volatility: An ongoing increase in energy prices may exert continuous upward pressure on consumer prices.

- Supply Chain Challenges: Disruptions linked to geopolitical tensions are contributing to pricing instability across multiple sectors.

- Consumer Demand Shifts: Growing demand in certain service sectors post-pandemic is likely to sustain inflation rates above projections.

With these inflationary signs becoming more pronounced, central banks may need to adopt a more aggressive stance regarding interest rates. Economists predict that a tightening of monetary policy could be on the horizon if inflation trends persist. A shift could potentially influence not only domestic market dynamics but also impact the broader European economic landscape. In light of these developments, a summary of analysts’ inflation forecasts and central bank responses is presented in the table below:

| Analyst Group | Inflation Forecast (%) | Central Bank Response |

|---|---|---|

| Group A | 1.2 | Gradual Rate Hikes |

| Group B | 1.5 | Immediate Intervention |

| Group C | 1.0 | Monitor Trends |

Recommendations for Navigating a Higher Inflationary Environment

As the preliminary inflation rate in France rises to 0.9% in July, slightly surpassing expectations, consumers and businesses alike must adapt their financial strategies to mitigate the effects of higher prices. Prioritizing essential expenditures can help in maintaining financial stability during these inflationary times. Consider reviewing and adjusting budgets to account for fluctuating costs, focusing on necessities such as food, housing, and transportation. Additionally, it may be beneficial to explore fixed-rate loans or long-term contracts that can shield against rising costs in the near future.

Investments also require careful consideration in a high-inflation climate. Diversifying your portfolio can act as a hedge against erosion of purchasing power. Look into inflation-protected securities or real assets that tend to maintain value during periods of inflation. Businesses should revisit their pricing strategies, ensuring they remain competitive while covering increased operating expenses. To facilitate better planning, here’s a quick look at the sectors likely to be impacted the most by inflation:

| Sector | Impact Level | Recommended Action |

|---|---|---|

| Food and Beverage | High | Review suppliers and negotiate contracts |

| Housing | Medium | Consider fixed-rate mortgages |

| Transportation | High | Explore carpooling or public transport |

| Healthcare | Medium | Assess insurance coverage options |

The Way Forward

In conclusion, the preliminary inflation figures released for July indicate a 0.9% rise in France, slightly exceeding analysts’ forecasts. This uptick underscores ongoing economic pressures as consumers face the persistent impact of rising prices across various sectors. Market observers will be closely monitoring subsequent data and potential policy responses from the European Central Bank. As inflation continues to affect purchasing power and economic stability, the implications for the broader Eurozone economy remain a pivotal topic for discussion in the coming weeks.