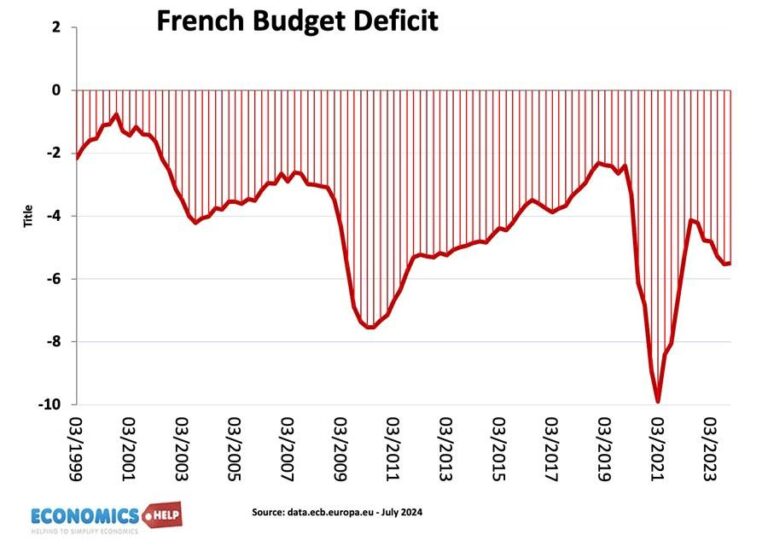

France is confronting a growing fiscal crisis, with Prime Minister warning that the nationŌĆÖs budget problems are ŌĆ£very serious.ŌĆØ As economic pressures mount and government spending remains high, concerns over FranceŌĆÖs financial stability are intensifying. The government faces the daunting task of balancing public demands with the need for fiscal responsibility, sparking debate across political and economic spheres. This article examines the implications of the Prime MinisterŌĆÖs stark assessment and what it means for FranceŌĆÖs economic future.

France Faces Mounting Fiscal Pressures Amid Economic Slowdown

France is grappling with intensifying budgetary challenges as economic growth slows and public spending outpaces revenue. The government has acknowledged that the current fiscal trajectory is unsustainable, raising concerns over the countryŌĆÖs ability to meet European Union fiscal rules. Key sectors, including healthcare, education, and social welfare, are under mounting strain, prompting calls for urgent reform and austerity measures to curtail the expanding deficit.

Key fiscal pressures include:

- Rising public sector wages and pension obligations

- Increased borrowing costs amid global economic uncertainty

- Lagging tax receipts due to weakened corporate earnings

| Fiscal Indicator | Current Year | Previous Year |

|---|---|---|

| Budget Deficit (% of GDP) | 4.5% | 3.9% |

| Public Debt (% of GDP) | 115% | 112% |

| Unemployment Rate | 8.1% | 7.5% |

Prime Minister Urges Swift Government Action to Address Deficit Concerns

FranceŌĆÖs fiscal landscape faces a critical juncture as the Prime Minister calls for immediate and decisive measures to curb the spiraling deficit. The governmentŌĆÖs reluctance to implement bold reforms, coupled with persistent economic challenges, has heightened concerns among policymakers and investors alike. The Prime Minister emphasized that without a swift recalibration of spending and revenue policies, the repercussions could be long-lasting, affecting not only domestic growth but also FranceŌĆÖs standing within the European Union.

The call to action includes several key priorities that the government must address promptly:

- Reevaluating public expenditure to eliminate inefficiencies

- Enhancing tax compliance and broadening the fiscal base

- Implementing structural reforms aimed at boosting economic competitiveness

- Strengthening social programs sustainably without jeopardizing financial stability

| Fiscal Indicator | 2023 | Projected 2024 | Target |

|---|---|---|---|

| Budget Deficit (% GDP) | 5.2% | 5.7% | 3.0% |

| Public Debt (% GDP) | 112% | 115% | 100% |

| Spending Growth Rate | +3.1% | +2.8% | Ōēż1.5% |

Policy Experts Advocate for Spending Cuts and Tax Reforms to Restore Balance

Leading policy analysts stress the urgency of implementing comprehensive spending cuts coupled with tax reform initiatives to mitigate the escalating fiscal deficit. They argue that without decisive measures, the public debt will continue to balloon, threatening economic stability and undermining investor confidence. Experts highlight the necessity of streamlining public expenditures, especially in sectors with bloated budgets, to create room for investment in growth-driving areas such as innovation and infrastructure.

On the tax front, specialists advocate for a more balanced system that not only boosts revenues but also fosters fairness. Among the key recommendations are:

- Reducing loopholes that disproportionately benefit high earners

- Implementing progressive tax brackets to protect middle- and low-income households

- Encouraging green taxes aimed at promoting environmental sustainability

| Measure | Potential Impact | Timeline |

|---|---|---|

| Cutting Administrative Spending | Reduce deficits by 2% | 1-2 years |

| Tax Code Simplification | Increase compliance, raise revenues | 2-3 years |

| Green Tax Implementation | Promote sustainability, new income stream | 3-5 years |

Public Response Mixed as Social Programs Hang in the Balance

As the government grapples with significant budget constraints, citizens and advocacy groups have voiced sharply divided opinions on the potential impact on social programs. While some express deep concern over cuts that could undermine essential services, others argue that fiscal discipline is necessary to stabilize the national economy. Public forums and social media channels have become battlegrounds for debates on austerity versus social welfare, reflecting a nation uneasy about its financial future.

Key points raised by the public include:

- Supporters of cuts: emphasize the importance of reducing national debt to maintain long-term economic health.

- Opponents: warn that reduced funding for healthcare, education, and housing will disproportionately affect vulnerable populations.

- Calls for compromise: urging the government to find innovative solutions rather than implementing blanket reductions.

| Program | Potential Impact | Public Concern Level |

|---|---|---|

| Healthcare | Service delays, staff shortages | High |

| Education | Resource cuts, larger class sizes | Moderate |

| Housing Assistance | Reduced availability, increased homelessness risk | High |

In Retrospect

As France grapples with mounting fiscal challenges, Prime MinisterŌĆÖs warning underscores the urgency for decisive policy action. The governmentŌĆÖs next steps will be closely watched by both domestic stakeholders and international observers, as the nation seeks a sustainable path forward amidst economic uncertainty. The developments in FranceŌĆÖs budgetary stance will remain a critical issue to monitor in the coming months.