Introduction:

In a notable turn of events, the European Union has signaled a willingness to accommodate France as the nation grapples with a staggering €53 billion budget deficit. At the center of this fiscal conundrum is François Bayrou, the Minister of Justice and a key political figure, who is spearheading efforts to address this financial shortfall. As the EU navigates the complexities of fiscal policy amidst diverse economic landscapes, Bayrou’s strategies to stabilize France’s budget are under scrutiny. This article explores the implications of the EU’s leniency and the potential impact on both France’s financial future and broader European economic stability.

EU’s Leniency towards Bayrou: Assessing the Implications for France’s Fiscal Health

The European Union’s recent decision to show leniency towards François Bayrou, tasked with addressing France’s staggering €53 billion fiscal gap, has ignited discussions about the long-term implications for the country’s financial stability. This unexpected flexibility from Brussels comes amidst rising inflation pressures and calls for increased public investment. Analysts have pointed out that while this can be seen as a short-term victory for Bayrou, it could set a precedent for future fiscal negotiations, potentially undermining the credibility of the Stability and Growth Pact aimed at maintaining fiscal discipline among member states.

Key implications of the EU’s leniency may include:

- Increased Borrowing Capacity: France may leverage this leniency to secure additional funds without immediately facing stringent restrictions.

- Impacts on Public Spending: The ability to maneuver could enable Bayrou to funnel resources into crucial areas like education and infrastructure.

- Investor Confidence: However, this might raise concerns among investors and stakeholders about fiscal irresponsibility going forward.

| Potential Risks | Description |

|---|---|

| Debt Sustainability | Higher public debt levels could jeopardize long-term economic health. |

| Market Reaction | Investors could demand higher returns on French bonds, increasing costs. |

Unpacking the €53 Billion Deficit: Causes and Consequences for the French Economy

France faces a significant challenge as its government grapples with a staggering €53 billion deficit, a situation that could have far-reaching implications for both fiscal policy and public services. Among the primary causes contributing to this financial black hole are soaring public spending and reduced revenue from taxes, exacerbated by the lingering impacts of the COVID-19 pandemic. Key factors include:

- Increased social welfare costs due to rising unemployment and support programs.

- Declining corporate tax revenues as businesses struggle to recover.

- Economic slowdown affecting GDP growth projections and tax income.

The consequences of this deficit are grave, impacting everything from public investments to national debt levels. Policymakers must navigate through a thicket of tough choices, as austerity measures may lead to deteriorating public trust. Additionally, the deficit reshapes France’s position within the EU, potentially complicating its ability to meet the bloc’s fiscal rules. Insights derived from current discussions highlight that failure to address the situation promptly could trigger rising interest rates and hinder France’s long-term economic recovery. The following table summarizes the projected impacts of the deficit on various sectors:

| Sector | Projected Impact |

|---|---|

| Public Services | Reduced funding and potential cuts |

| Infrastructure | Delayed projects and maintenance |

| Social Welfare | Increased burdens on public expenditure |

| Debt Servicing | Higher interest payments over time |

Strategic Recommendations: Navigating the Path to Financial Stability in France

As France grapples with a staggering €53 billion budget shortfall, focused strategic recommendations are essential for navigating this financial turbulence. Addressing the fiscal crisis calls for a multifaceted approach aimed at enhancing fiscal discipline while promoting growth. Key measures include:

- Streamlining Public Expenditure: Conducting a thorough review of public spending can unveil inefficiencies and redundant programs, allowing for significant cost reductions.

- Tax Reforms: Updating the tax system to ensure it is fair and equitable, while also broadening the tax base can boost revenue without overburdening citizens.

- Investment in Growth Sectors: Prioritizing investments in technology, renewable energy, and infrastructure can stimulate job creation and economic expansion.

Furthermore, engaging in dialogue with the European Union for potential fiscal flexibility could provide much-needed breathing room. Going forward, France could explore:

- Negotiating Temporary Deficits: Seeking allowances for temporary budget deficits to invest strategically in recovery while assuring compliance with EU regulations.

- Strengthening EU Relations: Leveraging collaborations with EU partners to access funding and expertise, particularly in implementing sustainable development projects.

- Public Consultations: Facilitating discussions with citizens to foster a sense of collective ownership over budgetary decisions and reinforce public trust.

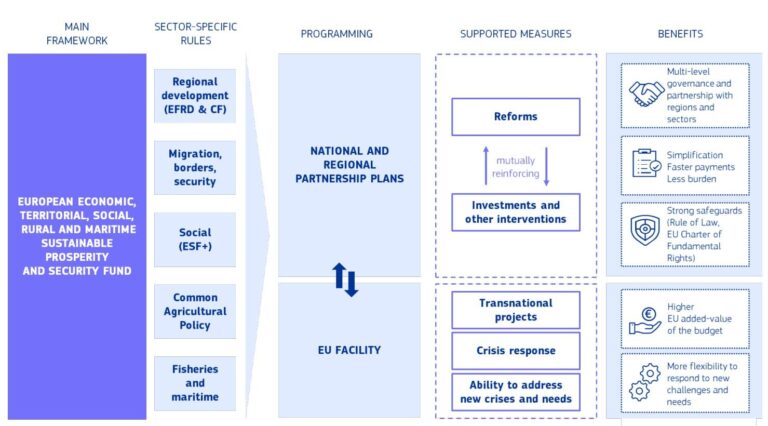

The Role of EU Oversight: Ensuring Accountability in National Budget Management

The European Union has shown a measured approach towards France’s accountability measures regarding the staggering €53 billion budget deficit. Amid mounting pressures for fiscal responsibility, the EU’s oversight mechanisms appear to tread lightly, allowing French officials, including François Bayrou, to outline reforms without facing immediate punitive actions. This leniency highlights a critical duality within EU governance: while efforts to stabilize national budgets are essential, maintaining flexibility can also foster collaborative growth among member states. Such a dynamic is crucial in the context of a united Europe, where economic interdependence raises the stakes for all involved.

Moreover, the situation underscores the importance of EU oversight in ensuring that national budget management aligns with broader fiscal frameworks. The structure of accountability involves a variety of key elements, including:

- Monitoring and Reporting: Regular assessments of national budgets against EU criteria.

- Conditional Funding: Linkage of EU funds to adherence to budgetary protocols.

- Collaborative Reform Initiatives: Encouraging member states to engage in best practices.

These mechanisms not only safeguard financial prudence but also empower countries to address their fiscal challenges while remaining aligned with EU objectives. As nations like France navigate tricky financial waters, the balance between oversight and support becomes increasingly vital.

In Conclusion

In conclusion, the European Union’s decision to take a lenient approach towards France’s François Bayrou amid efforts to address the significant €53 billion budget shortfall reflects a broader understanding of the unique fiscal challenges facing member states. As Bayrou navigates the complexities of financial stabilization, this development illuminates the delicate balance between EU regulations and the need for flexible solutions in times of economic distress. As negotiations continue and measures are implemented, stakeholders will be watching closely to see how France’s fiscal strategies evolve and the implications for EU cohesion in addressing similar challenges across the bloc.