Ryanair, EuropeŌĆÖs largest low-cost carrier, has announced plans to significantly reduce its operations in France in response to a newly implemented air tax increase, which the airline describes as ŌĆ£harmfulŌĆØ to its business model. The move comes amid growing tensions between budget airlines and governments over fiscal measures aimed at curbing environmental impact but widely criticized for their economic repercussions. This development signals potential disruptions for business travelers relying on RyanairŌĆÖs extensive French network and raises broader questions about the future of aviation taxation policies across Europe.

Ryanair Responds to French Air Tax Hike with Major Operational Cuts

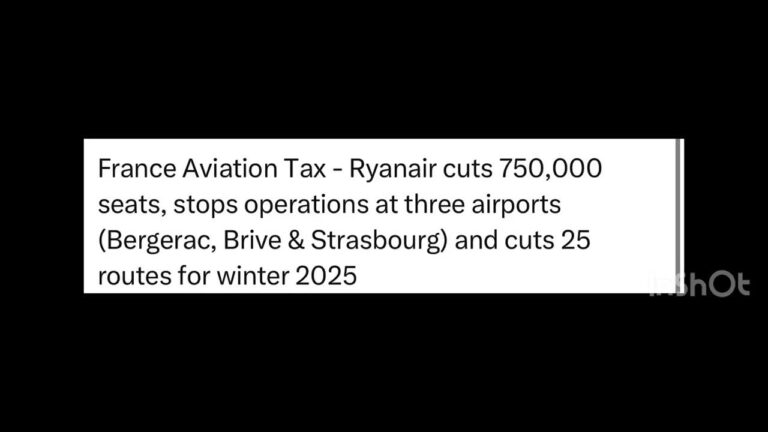

Ryanair has announced significant cutbacks in its French operations following the governmentŌĆÖs decision to increase air travel taxes. The airline described the hike as ŌĆ£harmfulŌĆØ to the industryŌĆÖs recovery post-pandemic, claiming it will lead to increased ticket prices and reduced connectivity. Ryanair emphasized that this fiscal policy threatens to undermine low-cost travel options across Europe, especially affecting regional airports and tourism-dependent communities.

The planned operational cuts include:

- Reduction of scheduled flights from major French hubs by 15%

- Closure of select routes deemed economically unviable under new tax conditions

- Withdrawal from smaller airports where costs have spiked significantly

| Region | Reduction % | Key Airports Affected |

|---|---|---|

| Île-de-France | 12% | Paris Beauvais, Paris Orly |

| Provence-Alpes-C├┤te d’Azur | 18% | Marseille, Nice |

| Occitanie | 20% | Toulouse, Montpellier |

Economic Impact of Air Tax Increase on European Low-Cost Carriers

The recent increase in the air tax imposed by the French government has sent shockwaves through the low-cost carrier (LCC) market. Ryanair, a key player in European budget travel, has publicly labeled the measure as ŌĆ£harmfulŌĆØ, citing its direct effect on operational costs and ticket pricing strategies. The airlineŌĆÖs decision to significantly reduce its French operations underscores the broader economic challenges posed by elevated taxes within a price-sensitive sector. This tax increment not only raises the cost base for carriers but also threatens to dampen passenger demand by elevating fares, potentially stifling market growth and reducing accessibility to affordable travel options across Europe.

The impact extends beyond Ryanair, affecting the entire LCC ecosystem. Increased air taxes can lead to a cascade of consequences, including:

- Reduced flight frequency and route discontinuations

- Job losses within the airline and associated airport services

- Competitive disadvantages against non-European or less-regulated carriers

Economic forecasts suggest potential disruptions to the aviation sectorŌĆÖs recovery post-pandemic. The table below illustrates a simplified comparative cost impact for LCCs before and after the tax hike:

| Cost Element | Before Tax Increase | After Tax Increase |

|---|---|---|

| Average Tax per Ticket | Ōé¼5 | Ōé¼12 |

| Operating Margin (%) | 9.5% | 6.0% |

| Estimated Fare Increase | ŌĆö | +8% |

Implications for French Tourism and Regional Connectivity

The decision by Ryanair to reduce its French operations in response to the new air tax hike poses significant challenges for the tourism sector. France, long a magnet for budget travelers, risks losing a substantial volume of visitors, especially those from neighboring countries who rely on low-cost carriers. The cutbacks could translate into fewer flight options and increased airfare prices, potentially discouraging spontaneous travel and limiting accessibility to lesser-known destinations. This scenario threatens to slow the momentum of regional tourism growth which had been bolstered by RyanairŌĆÖs expansive network and competitive fares.

Moreover, there are broader consequences for regional connectivity that go beyond just tourism revenues. Reduced frequency of flights can affect local economies that depend on sustained air traffic for both business and leisure travelers. The regional impacts include:

- Decreased accessibility to remote airports and regional hubs.

- Potential job losses linked to airport operations and ancillary services.

- Impediments to cross-border commerce and cultural exchange.

| Region | Impact | Potential Recovery Measures |

|---|---|---|

| Normandy | Flight frequency drops by 30% | Subsidies, marketing campaigns |

| Occitanie | Loss of key budget routes | Improved rail connections |

| Grand Est | Reduced inbound tourists | Partnerships with alternative carriers |

Strategies for Airlines to Navigate Rising Environmental Levies

Airlines facing increased environmental levies on flights must adopt agile approaches to sustain profitability while adhering to growing regulatory pressures. One effective strategy includes rerouting operations to countries with lower or no aviation taxes, allowing airlines to maintain competitive pricing without compromising on service. Additionally, the implementation of investment in more fuel-efficient aircraft can help reduce both carbon emissions and operating costs, offsetting some of the financial burdens imposed by these levies.

Complementing operational changes, airlines can explore diversification of revenue streams by enhancing ancillary services, such as premium seating, in-flight sales, and loyalty programs. Collaborative efforts through industry-wide carbon offset programs also provide avenues for reducing environmental impact. The table below outlines key strategies alongside their benefits:

| Strategy | Benefits |

|---|---|

| Rerouting to Low-Tax Markets | Cost savings, market retention |

| Fleet Modernization | Fuel efficiency, emission reduction |

| Ancillary Revenue Expansion | Increased profitability, customer loyalty |

| Participation in Carbon Offset Programs | Environmental compliance, brand image |

The Way Forward

The decision by Ryanair to reduce its presence in the French market underscores the significant impact of increased air taxes on airline operations. As the low-cost carrier shifts capacity away from France, the move highlights ongoing tensions between government tax policies and the aviation industry’s efforts to maintain affordable travel options. Stakeholders will be closely watching how this development influences the broader European market and whether it prompts further policy reconsiderations.