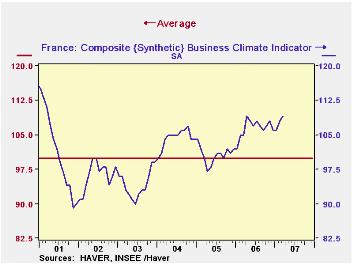

France’s business climate indicator held steady in the latest assessment, signaling consistent economic sentiment among companies across the country. According to data reported by TradingView, key metrics reflecting business confidence showed little change, suggesting stability in France’s economic outlook amid ongoing global uncertainties. This steadiness offers insight into corporate expectations and potential trends in investment and growth as the nation navigates complex market conditions.

France Business Climate Indicator Holds Steady Amid Global Economic Uncertainty

Despite ongoing fluctuations in the global economy, France’s business climate remained resilient, reflecting a stable environment for investors and domestic companies alike. Economic analysts note that this steadiness comes amid widespread concerns over inflation, supply chain disruptions, and shifting geopolitical dynamics that continue to pressure markets worldwide. The indicator’s ability to hold steady suggests underlying confidence in France’s economic policies and its adaptability to external shocks.

Key factors contributing to this stability include:

- Strong consumer demand supporting domestic business activity

- Robust government stimulus programs aimed at boosting key sectors

- Improved export performance driven by trade partnerships within the EU

- Ongoing innovation and digital transformation efforts in French industries

| Month | Business Climate Index | Change (%) |

|---|---|---|

| April | 101.2 | 0.0 |

| March | 101.2 | 0.0 |

| February | 100.8 | +0.4 |

Sector-Specific Performance Highlights Stability in Manufacturing and Services

The latest business climate data reveals a robust steadiness across key economic sectors, particularly manufacturing and services. Manufacturing output showed consistent demand levels, supported by sustained domestic consumption and a modest rebound in export orders. Meanwhile, service industries, encompassing retail, hospitality, and professional services, maintained their momentum, benefiting from ongoing consumer confidence and gradual easing of global supply constraints.

Key performance indicators highlight the following trends:

- Manufacturing PMI: Held steady at 50.5, indicating stable production volume.

- Service Sector Growth: Expanded by 1.2% compared to the previous quarter.

- Employment Trends: Both sectors reported marginal job growth, reflecting cautious optimism among employers.

| Sector | Current Index | Change (QoQ) | Forecast Outlook |

|---|---|---|---|

| Manufacturing | 50.5 | +0.3 | Stable |

| Services | 52.1 | +0.5 | Positive |

Implications for Investors Navigating the French Market Landscape

Investors should recognize that the stable business climate indicator in France signals a period of cautious optimism rather than rapid growth, encouraging a measured approach to capital deployment. While the economy remains resilient, uncertainties in sectors such as manufacturing and consumer goods suggest that diversification and risk assessment become paramount. Strategic asset allocation grounded in sectors with steady domestic demand, alongside export-oriented industries, could shield portfolios against potential volatility.

- Focus on sectors with consistent performance: healthcare, technology, and green energy.

- Monitor policy changes closely: fiscal incentives and regulatory adjustments may influence market dynamics.

- Emphasize quality and sustainability: companies with strong governance and ESG credentials are emerging winners.

| Factor | Potential Impact | Investor Action |

|---|---|---|

| Stable Business Indicator | Moderate growth expectations | Balanced portfolio approach |

| Consumer Confidence | Steady spending patterns | Selective retail and service investments |

| Regulatory Environment | Possible policy shifts | Close monitoring and agility |

Moreover, global market linkages mean that French investors cannot afford isolated strategies. The interplay between France’s economic stability and broader European monetary policies suggests that currency fluctuations and cross-border trade relations will directly impact returns. Staying informed and agile, particularly with respect to evolving trade agreements and geopolitical risks, will be vital. The emphasis on innovative technologies and sustainable initiatives offers a clear avenue for investors seeking growth within a framework of stability and long-term value appreciation.

Policy Recommendations to Sustain Business Confidence and Growth

To maintain the current stability of the business climate in France, policymakers should prioritize targeted fiscal measures that encourage innovation and entrepreneurship. This includes increased investment in digital infrastructure to foster tech-driven growth and the simplification of regulatory frameworks to reduce administrative burdens on small and medium-sized enterprises (SMEs). By empowering SMEs with easier access to financing and support services, the government can stimulate job creation and enhance economic resilience amid global uncertainties.

- Enhance support for startups and scale-ups through tax incentives and grant programs

- Promote sustainable business practices with subsidies for green technologies

- Expand vocational training to close skill gaps and increase workforce adaptability

Further, implementing adaptive monetary policies that balance inflation control with growth support is crucial. Collaboration between the public and private sectors to monitor market signals and adjust responses swiftly can help preserve investor confidence. Policymakers must also emphasize transparency and consistent communication to mitigate uncertainty. The following table outlines key policy tools and their projected impact on business confidence and growth:

| Policy Tool | Objective | Expected Outcome |

|---|---|---|

| Tax Relief for SMEs | Reduce operational costs | Increased investments and job growth |

| Green Subsidies | Promote eco-friendly innovation | Lower emissions, new market opportunities |

| Vocational Training Expansion | Address skills shortage | Enhanced productivity and workforce mobility |

Concluding Remarks

In summary, the France Business Climate Indicator maintained its stable footing in the latest assessment, reflecting steady economic sentiment amid ongoing global uncertainties. Analysts suggest that this consistency may signal cautious optimism among French businesses as they navigate current challenges. Market participants and policymakers will be closely monitoring upcoming data releases to gauge any shifts that could impact the broader economic outlook.