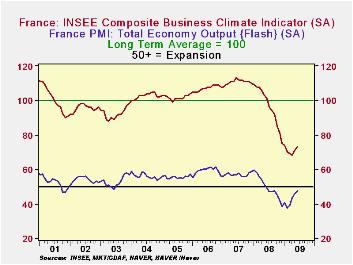

In March, France’s business climate demonstrated a notable improvement, signaling growing confidence among companies across various sectors. According to the latest data reported by TradingView, key indicators revealed a positive shift, reflecting stronger economic sentiment and an optimistic outlook for the coming months. This rise in business confidence underscores potential momentum in France‚Äôs economic recovery amid ongoing domestic and global challenges.

France Business Climate Shows Strong Improvement in March

Activity indicators across multiple sectors in France reflected a notable upswing this March, signaling renewed investor confidence and business optimism. Key contributing factors include a surge in manufacturing output, a rebound in consumer spending, and easing supply chain constraints. These improvements have catalyzed stronger forecasts for near-term growth, with many companies reporting better-than-expected order books and hiring intentions.

Policymakers and market analysts alike have hailed this momentum as a positive indicator for the Eurozone’s second-largest economy. Below is a snapshot of the latest business climate components that underscore this uplifting trend:

- Manufacturing PMI: Rose to 52.3, surpassing market expectations.

- Consumer Sentiment: Improved to 101, the highest since Q4 2022.

- Business Confidence Index: Increased from 99 to 104.

| Sector | March Index | Change vs. Feb |

|---|---|---|

| Manufacturing | 54.1 | +2.5% |

| Retail | 103.7 | +3.1% |

| Services | 101.4 | +1.8% |

Key Sectors Driving Economic Optimism in France

Technology and innovation stand out as pivotal sectors propping up France’s optimistic economic trajectory this March. The surge in digital transformation initiatives has fueled robust growth in software development, IT services, and high-tech manufacturing. Startups and established firms alike are capitalizing on favorable government incentives and increasing private investments, which have collectively enhanced business confidence across these industries.

Meanwhile, the renewable energy and green technology sectors continue to gain momentum, driven by France’s commitment to environmental targets and sustainable development. Wind, solar, and energy storage projects have attracted significant capital inflows, generating employment opportunities and supporting regional economies. The following table highlights recent investment trends in these key sectors:

| Sector | Q1 2024 Investment (‚ā¨ Billion) | Year-on-Year Growth |

|---|---|---|

| Technology & Innovation | 3.8 | 12% |

| Renewable Energy | 2.5 | 18% |

| Manufacturing | 1.9 | 7% |

Expert Analysis on Factors Behind the Business Climate Upswing

After months of uncertainty, several key elements converged to foster an optimistic turn in France’s business climate. Among the primary drivers, improvements in manufacturing output have been pivotal, supported by a rebound in international demand. Additionally, government stimulus measures aimed at revitalizing sectors hit hardest by the pandemic have alleviated immediate financial pressures on enterprises. Experts also attribute this uplift to rising consumer confidence, spurred by accelerated vaccination rates and easing restrictions, which has positively influenced retail and service industries across the country.

Further analysis reveals a nuanced interplay of factors contributing to this upswing:

- Supply Chain Stabilization: Disruptions that plagued the first quarters of 2023 slowly improved, allowing manufacturers to better meet orders.

- Energy Price Adjustments: Recent declines in energy costs have lowered operational expenses for many businesses.

- Technological Adaptations: Increased digital transformation initiatives have enhanced efficiency and market reach.

| Factor | Impact on Business Climate |

|---|---|

| Manufacturing Output | Significant increase |

| Government Stimulus | Moderate boost |

| Consumer Confidence | Rising steadily |

| Energy Cost Trends | Lowered operational costs |

Strategic Recommendations for Investors in the French Market

With the positive momentum in France’s business climate this March, investors should prioritize sectors demonstrating resilience and innovation. Technology and renewable energy industries have notably benefited from increased governmental support and evolving consumer preferences, making them prime areas for capital allocation. Additionally, close attention to mid-cap companies that have strong domestic market penetration could yield substantial growth given their agility in adapting to economic shifts.

To navigate the fluctuating environment effectively, diversification remains key. Investors are encouraged to consider a balanced portfolio that includes:

- Consumer goods firms catering to evolving lifestyle demands

- Financial services with a focus on fintech innovations

- Export-oriented manufacturers benefiting from favorable Eurozone trade dynamics

| Sector | Growth Potential | Risk Level |

|---|---|---|

| Technology | High | Medium |

| Renewable Energy | Medium-High | Medium |

| Consumer Goods | Medium | Low |

| Financial Services | Medium | Medium |

The Conclusion

In summary, the rise in France’s business climate index this March reflects growing confidence among companies amid ongoing economic uncertainties. Market watchers and policymakers will be closely monitoring these developments as they signal potential momentum for the French economy in the coming months. As businesses navigate evolving challenges, the improved outlook offers a cautiously optimistic perspective on France‚Äôs economic trajectory moving forward.