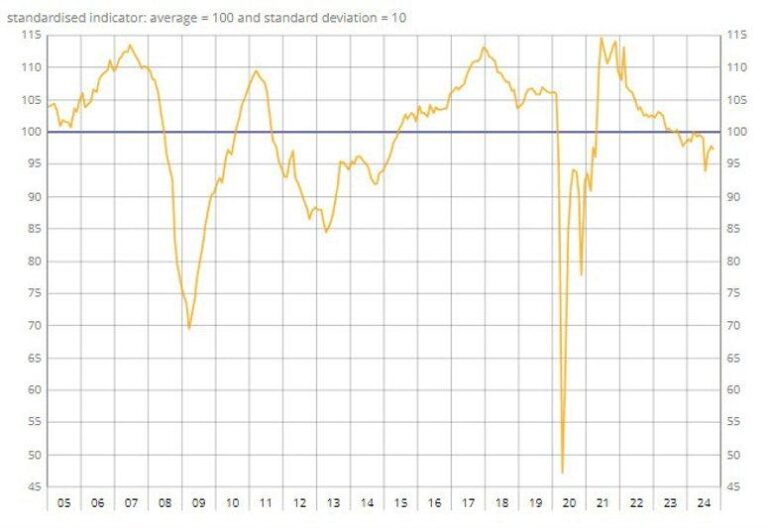

Business confidence in both France and Germany has taken a sharp downturn, intensifying concerns over the eurozone’s economic resilience. Recent surveys reveal a marked decline in sentiment among key industries, raising the possibility that the European Central Bank (ECB) may consider an interest rate cut to stimulate growth. As the bloc’s two largest economies show signs of weakening, policymakers and investors alike are closely watching for signals of the ECB’s next move.

French and German Business Confidence Decline Signals Growing Economic Concerns

Recent data points to a significant drop in business confidence across France and Germany, two of the Eurozone’s economic powerhouses. Industry leaders in both countries cited concerns related to persistent supply chain disruptions, rising energy costs, and geopolitical tensions impacting export markets. This growing unease among businesses has led economists to speculate on the potential for the European Central Bank (ECB) to shift its monetary policy stance, possibly considering an interest rate cut to cushion the downside risks faced by the region.

Key factors influencing the decline include:

- Manufacturing slowdowns due to delayed critical components

- Inflation pressures squeezing profit margins and consumer demand

- Uncertainty over EU fiscal policies exacerbating investment hesitancy

| Indicator | Previous Month | Current Month | Change |

|---|---|---|---|

| French Business Confidence Index | 101 | 94 | -7 |

| German Business Confidence Index | 98 | 90 | -8 |

| Eurozone Composite PMI | 49.5 | 47.8 | -1.7 |

With these downturns reflecting deeper economic vulnerabilities, market watchers now reckon the ECB may soon pivot to stimulate growth. This marks a notable shift after a period of tightening monetary policy, underscoring the delicate balance policymakers face amid competing inflationary and growth concerns.

ECB Faces Mounting Pressure as Eurozone Manufacturing and Services Sectors Weaken

Analysts highlight several immediate challenges the ECB faces:

- Manufacturing output contracting in major Eurozone economies

- Services sector growth deceleration, particularly in consumer-driven industries

- Inflation rates remaining sticky despite cooling economic activity

Below is a snapshot of recent confidence indices illustrating the downward trend:

| Country | Business Confidence (April 2024) | Previous Month |

|---|---|---|

| France | -9.5 | -6.8 |

| Germany | -11.2 | -7.9 |

Analysts Warn of Potential Monetary Policy Shift Amid Lingering Inflation Risks

Market experts highlight several factors contributing to this shift:

- Rising borrowing costs: Higher interest rates have dampened investment appetite and consumer spending.

- Supply chain disruptions: Ongoing challenges continue to delay production and inflate costs.

- Geopolitical uncertainties: Energy supply concerns and global tensions exacerbate business hesitancy.

| Country | Business Confidence Index (Current) | Previous Month | Change (%) |

|---|---|---|---|

| France | 88.7 | 92.4 | -4.0% |

| Germany | 81.1 | 85.3 | -4.9% |

Businesses Urged to Prepare for Possible Market Volatility and Adjust Investment Strategies

To navigate this volatile environment effectively, businesses should focus on:

- Diversifying investments to reduce exposure to sector-specific downturns

- Enhancing liquidity reserves to maintain operational flexibility during uncertain periods

- Monitoring currency risks amid Euro fluctuations linked to ECB policy shifts

- Reassessing supply chains to mitigate impacts from external economic pressures

| Risk Factor | Potential Impact | Recommended Strategy |

|---|---|---|

| Market Volatility | Asset value fluctuations | Portfolio diversification |

| Interest Rate Changes | Borrowing cost adjustments | Lock in fixed-rate loans |

| Euro Currency Shifts | Profit margin variability | Hedging currency exposure |

The Way Forward

As French and German business confidence indicators continued their decline, market watchers are now closely monitoring the European Central Bank’s next move. The weakening sentiment in two of the Eurozone’s largest economies increases speculation that the ECB may opt for an interest rate cut to support growth and stave off recessionary pressures. Investors and policymakers alike will be watching upcoming economic data for further signals on the bloc’s trajectory, as the central bank balances inflation concerns against the risks of economic slowdown.