FranceŌĆÖs Cannabis Consumption: A Call for Progressive Policy Overhaul

Examining countries with legalized or decriminalized cannabis markets reveals tangible benefits, including diminished illicit trade and increased fiscal income. For France, a thoughtfully crafted regulatory model might encompass:

- Enforcement of age limits and stringent product quality standards to protect consumers

- Taxation policies designed to align with public health objectives

- Reinvestment of generated tax funds into education, addiction treatment, and community support programs

| Country | Adult Cannabis Use (%) | Legal Status | Annual Tax Revenue (Million Ōé¼) |

|---|---|---|---|

| France | 31 | Illegal | Not Applicable |

| Portugal | 18 | Decriminalized | 50 |

| Netherlands | 23 | Legalized (regulated) | 120 |

| Luxembourg | 20 | Legalized | 35 |

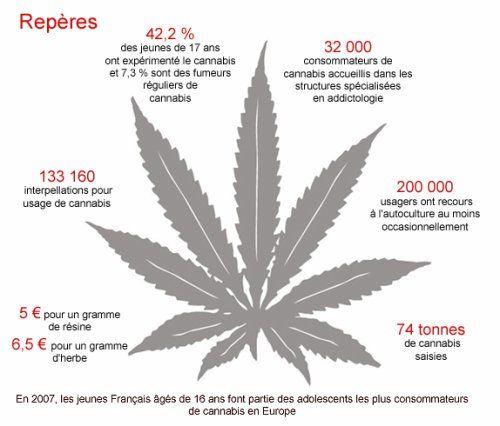

The Socioeconomic Consequences of Cannabis Use in France

Advantages of Establishing a Legal Cannabis Market in France

From a public health perspective, regulated access facilitates the deployment of educational initiatives that encourage responsible use and reduce potential harmsŌĆöefforts that are challenging under prohibition. Moreover, decriminalization paired with taxation would ease the burden on the criminal justice system by decreasing cannabis-related prosecutions, which often disproportionately affect disadvantaged populations. The following table highlights the primary benefits:

| Benefit | Explanation |

|---|---|

| Economic Expansion | Substantial tax revenue generation and employment growth |

| Crime Mitigation | Reduction of illegal trade and enhancement of public safety |

| Health Improvements | Quality assurance and focused educational campaigns |

| Judicial Relief | Fewer arrests and lower incarceration rates related to cannabis |

Guidelines for Crafting an Effective Cannabis Taxation Policy

Incorporating social equity into the policy framework is essential. Allocating a portion of tax revenues to public health programs, addiction prevention, and community development can help offset potential negative consequences. Key strategic elements include:

- Variable taxation: Differentiated by product type and potency

- Robust licensing: Ensuring compliance and product safety

- Revenue distribution: Funding education, prevention, and social initiatives

- Ongoing evaluation: Data-driven adjustments to tax and regulatory policies

| Policy Component | Expected Outcome | Recommended Measures |

|---|---|---|

| Taxation Model | Market regulation and revenue optimization | Implement tiered taxes based on THC levels |

| Regulatory Oversight | Consumer protection and market integrity | Enforce strict licensing and quality control |

| Revenue Allocation | Social equity and public health support | Direct funds to prevention and education programs |

| Policy Monitoring | Effectiveness and adaptability | Conduct regular reviews and policy updates |

Conclusion: Embracing Reform for a Healthier, Prosperous Future

As France continues to top European charts in cannabis consumption, the urgency for a reformed regulatory and taxation framework intensifies. Alexander HurstŌĆÖs insights in The Guardian underscore the missed opportunities inherent in maintaining prohibitionŌĆöboth in terms of public health management and economic gains. With shifting public attitudes and increasing political momentum, France stands at a crossroads: to either persist with outdated policies or to pioneer a progressive model that transforms cannabis use into a catalyst for social equity and fiscal growth. The decisions made in the near future will be pivotal in shaping the nationŌĆÖs approach to one of its most prevalent substances.