The French offshore wind sector is facing significant uncertainty amid a mounting government crisis, according to a recent report by Marine Link. As political instability disrupts policy continuity, key projects and investment plans in one of EuropeŌĆÖs fastest-growing renewable energy markets are at risk. Industry stakeholders warn that delays and regulatory hesitations could hamper FranceŌĆÖs ambitious targets for offshore wind capacity expansion, potentially affecting the countryŌĆÖs broader climate goals and energy transition efforts.

French Offshore Wind Sector Faces Uncertainty Amid Government Turmoil

The recent political instability in France has cast a shadow over the promising offshore wind industry, raising concerns among investors and stakeholders. Delays in policy announcements and budget allocations have stalled several key projects, threatening to undermine the nationŌĆÖs ambitious renewable energy targets. Industry leaders are urging the government to stabilize the political landscape to ensure uninterrupted progress, emphasizing that continuity and clear regulatory frameworks are crucial for maintaining investor confidence.

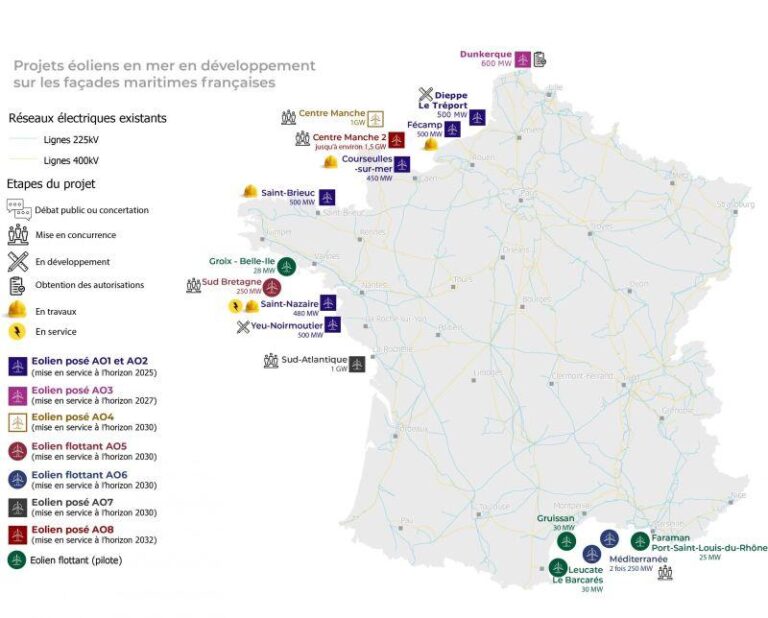

- Project Delays: Several offshore wind farms have faced postponements due to the absence of finalized contracts.

- Investment Hesitation: Uncertainty has led to cautious approaches from both domestic and international investors.

- Energy Goals at Risk: The national target of 40 GW offshore wind capacity by 2050 may be jeopardized.

| Project | Capacity (MW) | Current Status |

|---|---|---|

| Saint-Nazaire | 480 | Paused |

| F├®camp | 498 | Uncertain |

| Courseulles-sur-Mer | 450 | Delayed |

Economic and Environmental Consequences for Renewable Energy Targets

The ongoing political instability has cast a shadow over France’s ambitious renewable energy agenda, threatening to slow progress on crucial offshore wind projects. Delays in policy decisions and funding approvals are creating uncertainty for investors and developers, potentially inflating costs and extending timelines. This disruption not only hampers the expansion of clean energy capacity but also risks France falling short of its robust targets for carbon emissions reduction by 2030.

Economic repercussions extend beyond immediate project setbacks. Industry stakeholders warn of potential job losses in emerging sectors and reduced competitiveness in the global clean energy market. On the environmental front, slower deployment of offshore wind farms diminishes momentum in transitioning away from fossil fuels. Below is an overview of anticipated impacts:

- Increased project costs: Regulatory delays may escalate expenses by 10-15%

- Employment uncertainty: Potential layoffs threaten the growth of a skilled workforce

- Carbon target risks: Slower capacity additions endanger compliance with EU climate mandates

- Ecosystem benefits delayed: Reduced offshore wind integration may prolong reliance on polluting energy sources

| Impact Area | Estimated Effect | Timeframe |

|---|---|---|

| Project Costs | +12% | Next 2 years |

| Job Market | ŌłÆ8% workforce reduction | 2024-2025 |

| Emissions Goals | Delay by 1 year | By 2030 |

Stakeholder Responses and Industry Calls for Policy Stability

Industry leaders and key stakeholders across the French offshore wind landscape have voiced significant concern over the recent government upheaval. Many emphasize that while the transition period may be temporary, any delays in policy execution could stall critical projects, jeopardizing FranceŌĆÖs ambitions to expand its renewable energy capacity. Prominent voices in the sector advocate for clear, consistent communication from policymakers to maintain investor confidence and safeguard ongoing development initiatives.

Calls for policy stability have been underscored by a range of stakeholders including developers, environmental organizations, and financial backers. Their unified appeal stresses the importance of:

- Maintaining existing offshore wind frameworks without sudden regulatory shifts.

- Ensuring prompt allocation of permits and subsidies.

- Providing transparent timelines to avoid market uncertainty.

| Stakeholder Group | Primary Concern | Preferred Action |

|---|---|---|

| Industry Developers | Permit delays | Faster approvals |

| Investors | Financial risk | Stable policy guarantees |

| Environmental NGOs | Project disruptions | Clear sustainability guidelines |

Strategic Recommendations to Safeguard Project Continuity and Investment Confidence

To mitigate the risks posed by governmental instability, stakeholders must prioritize robust frameworks that enhance project resilience. These include diversifying investment sources beyond traditional public funds to engage private equity and international green finance entities, thereby minimizing reliance on shifting policy priorities. Equally critical is the establishment of clear, long-term regulatory roadmaps that reaffirm commitment to offshore wind targets, reassuring investors and developers amid uncertainty.

- Implement binding multi-year contracts to protect project timelines

- Enhance stakeholder engagement through transparent communication channels

- Develop contingency strategies that anticipate policy fluctuations

Furthermore, fostering collaborative alliances between government agencies, industry leaders, and local communities will play a pivotal role in sustaining momentum. By pooling expertise and resources, these partnerships can accelerate technological innovation and streamline permitting processes, ultimately reducing delays caused by administrative bottlenecks. Focused efforts on reinforcing grid integration and supply chain resilience will also buttress operational continuity despite political upheavals.

Key Takeaways

As the French government grapples with ongoing political uncertainty, the offshore wind sector faces significant challenges that could delay critical projects and hamper the countryŌĆÖs renewable energy ambitions. Stakeholders and industry observers will be closely monitoring developments in the coming months to assess how policy shifts may influence FranceŌĆÖs transition to a greener energy future. The outcome of this crisis will not only shape the nationŌĆÖs marine energy landscape but could also have broader implications for European offshore wind markets.