Introduction

In the face of escalating political paralysis and economic unease, France is turning its gaze toward its wealthiest citizens as a potential solution to restore fiscal vitality and social balance. In a bold move that prioritizes equity and economic revitalization, policymakers are exploring strategies to address wealth concentration through increased taxation and financial reforms. This approach not only reflects growing public dissatisfaction but also seeks to bridge divides exacerbated by global economic pressures. As the nation grapples with these complexities, the implications of such policies could reshape the socio-economic landscape, challenging longstanding perceptions of wealth and responsibility in one of Europe’s largest economies.

France Targets Affluent Citizens to Alleviate Economic Stagnation

In a bold move to revive its stagnant economy, France is turning its focus towards its wealthiest citizens, implementing a series of strategic financial measures designed to stimulate growth and enhance fiscal sustainability. These initiatives aim to redefine the country’s approach to wealth generation by leveraging the financial power of affluent individuals. The French government is proposing a restructured tax regime that includes:

- Increased taxes on luxury goods to encourage consumption shifts towards more sustainable options.

- Tax incentives for investments in local businesses, particularly startups focused on innovation and sustainability.

- Streamlined regulations aimed at fostering a more favorable environment for high-net-worth individuals to reinvest in the French economy.

By targeting these affluent segments, France aims not only to alleviate its economic stagnation but also to engender a sense of social responsibility among the rich. A recent study highlighted that households in the top income bracket contribute disproportionately to the nation’s GDP; thus, capitalizing on their financial capacity could provide the necessary boost to key sectors. The government plans to monitor the effectiveness of these measures through:

| Measure | Expected Outcome |

|---|---|

| Luxury Tax Increase | Higher revenue for public services |

| Investment Incentives | Boost in startup funding |

| Regulatory Reforms | Improved business environment |

Policy Shifts: Examining Proposed Tax Reforms for Wealth Redistribution

In a decisive move to address growing inequality and invigorate political momentum, the French government has unveiled a series of proposed tax reforms aimed directly at the wealthiest individuals. These initiatives seek to not only redistribute wealth but also to stimulate economic growth through increased public funding for essential services. Key components of the proposed reforms include:

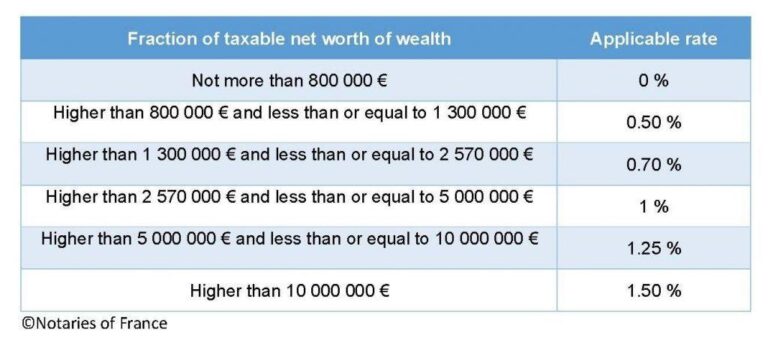

- Increase in Wealth Taxes: A significant rise in taxes for individuals with assets exceeding a set threshold.

- Progressive Income Tax Rates: Adjustments to tax brackets that will see higher-income earners contributing a greater percentage of their income.

- Reduction of Tax Loopholes: Stricter regulations to close loopholes that allow the wealthy to evade fair taxation.

The proposed measures have sparked a heated debate among political factions, with proponents arguing that these tax reforms are essential for funding social programs and reducing the national deficit. In contrast, critics warn that such changes could deter investment and threaten economic stability. To illustrate the potential impact of these reforms on the economy, consider the following table:

| Income Level | Current Tax Rate | Proposed Tax Rate |

|---|---|---|

| Up to €50,000 | 20% | 20% |

| €50,001 to €150,000 | 30% | 35% |

| Above €150,001 | 45% | 50% |

As the government prepares to navigate this politically charged landscape, the outcome of these proposed tax reforms could very well set the tone for future economic policies and the overall direction of France’s approach to wealth inequality.

Public Response: Societal Impacts of Wealth-Centric Legislation

The recently unveiled wealth-centric legislation in France has sparked a profound shift in public perception. Supporters view it as a necessary measure to ensure financial equity and social responsibility among the affluent. Critics, however, argue that targeting the wealthy could deepen societal divides and stifle economic innovation. Many believe the act will encourage a more altruistic business culture, where well-off citizens contribute to community welfare through increased taxation. Key points of public reaction include:

- Support for greater social investment: Many citizens welcome the prospect of enhanced funding for public services.

- Concerns over economic repercussions: Detractors warn of potential job losses as wealthy individuals might relocate to tax-friendlier environments.

- Calls for transparency: There is a growing demand for clarity on how the generated revenue will be utilized.

This legislative move has the potential to redefine the relationship between wealth and governance in France. As debates rage on social media and public forums, the discourse is increasingly focused on long-term societal implications rather than short-term gains. A recent survey of public opinion revealed that while a majority supports the initiative, there exists a significant faction wary of government overreach. The table below highlights public sentiment based on recent polling data:

| Sentiment | Percentage |

|---|---|

| Supportive | 68% |

| Neutral | 15% |

| Opposed | 17% |

Strategic Recommendations for Sustaining Economic Growth and Stability

To navigate the current political stalemate and foster economic momentum, several strategic recommendations should be considered. Targeting high-income individuals for tax reforms could generate significant revenue while addressing fiscal imbalances. By implementing a progressive tax system, France could not only increase public spending on essential services but also stimulate middle-class consumption, which is vital for sustainable growth. Key elements of this approach may include:

- Establishing higher tax brackets for the wealthiest individuals.

- Incentivizing investments in local businesses through tax credits.

- Promoting transparency in wealth declaration to reduce tax evasion.

In addition, leveraging public-private partnerships (PPPs) can expedite infrastructure development and innovation. By collaborating with private entities, the government can tap into additional resources and expertise, mitigating the burden on public finances. An effective PPP structure should focus on:

- Enhancing digital infrastructure to support a thriving tech sector.

- Revitalizing public transport systems to improve connectivity and reduce emissions.

- Creating a framework for sustainable urban development projects.

| Strategy | Potential Outcome |

|---|---|

| Progressive Taxation | Increased Revenue |

| Public-Private Partnerships | Faster Infrastructure Development |

| Investment Incentives | Boosted Local Business Growth |

The Way Forward

As France grapples with political gridlock, the government’s bold pivot toward taxing the wealthy marks a significant shift in its economic strategy. This move aims not only to address pressing fiscal challenges but also to restore public trust in governance. While it may provoke debate and dissent among those targeted, the potential for renewed economic investment and social equity cannot be overlooked. As the nation navigates this complex landscape, the outcomes of these reforms will be closely monitored, setting the stage for a potential revival of political engagement and financial stability. In a time of uncertainty, France’s approach may serve as a crucial test of how governments can adapt and respond to the aspirations of their citizens. The road ahead promises to be tumultuous, yet it is a necessary endeavor in the pursuit of a more equitable society.