France’s Debt Rating Cut on Fears of Political Instability

In a significant shift for one of Europe’s largest economies, France has experienced a downgrade in its debt rating, reflecting growing concerns over political instability within the country. The decision, announced by a leading credit rating agency, comes amidst rising tensions over governmental reforms and widespread public discontent. Analysts warn that this downgrade could have far-reaching implications, not only for France’s financial markets but also for its role in the broader European economy. As the government grapples with mounting challenges, observers are left to question how this development might affect France’s fiscal health and its ongoing recovery from economic setbacks.

France Faces Debt Rating Downgrade Amid Rising Political Uncertainty

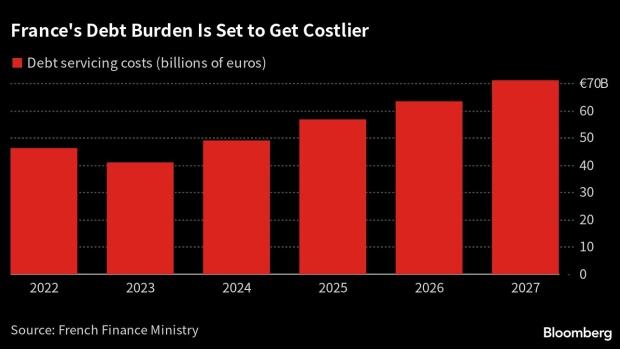

The recent downgrade of France’s debt rating has sent shockwaves through financial markets, highlighting deepening concerns over political stability within the nation. Analysts point to a series of tumultuous events, including widespread protests and a fragmented parliament, as key factors contributing to this shift. The credit agency’s decision reflects fears that ongoing uncertainty will hinder economic recovery plans, potentially leading to higher borrowing costs for the French government. Financial experts warn that a weakened credit rating could stifle investments and slow down growth, exacerbating existing economic challenges.

In light of this development, several economic indicators are worth noting:

| Indicator | Current Status |

|---|---|

| GDP Growth Rate | 1.5% (Projected for 2023) |

| Unemployment Rate | 7.1% |

| Public Debt to GDP | 115% |

Additionally, the government’s proposed reforms are facing mounting opposition, which could further complicate fiscal strategies aimed at stabilizing the economy. Key stakeholders emphasize the need for collaborative efforts across political lines to restore investor confidence and to navigate the murky waters ahead.

Impact of Political Instability on France’s Economic Outlook

The recent downgrade of France’s debt rating underscores the fragile state of its economic environment, heavily influenced by the uncertainties in the political arena. Investors and economists alike are voicing concerns about the government’s ability to implement necessary reforms amidst rising social unrest and shifting political alliances. These factors have deep implications for France’s fiscal policies and its long-term economic growth. Key concerns include:

- Investor Confidence: Uncertainty surrounding political stability erodes trust in governmental policies, negatively impacting investment levels.

- Public Spending: Political factions struggle to agree on budgetary measures, risking cuts in essential services that could further stifle growth.

- Economic Reform Delays: Vital reforms needed to address unemployment and national debt may be postponed, prolonging economic malaise.

As the situation develops, the potential fallout from such instability is becoming clearer. Future GDP projections lack the optimism previously seen, and analysts warn that prolonged political uncertainty might lead to a sustained economic downturn. A closer examination reveals:

| Key Economic Indicators | Current Status | Projected Outlook |

|---|---|---|

| GDP Growth Rate | 1.5% | 1.0% (next year) |

| Unemployment Rate | 7.1% | 7.5% (next year) |

| National Debt | 112% of GDP | 116% of GDP (next year) |

Expert Insights: Strategies to Mitigate Debt Concerns

The recent downgrade of France’s debt rating underscores the pressing need for effective strategies to tackle financial concerns stemming from political instability. Key measures that can be implemented include:

- Enhanced Fiscal Policies: Strengthening budgetary frameworks can help improve investor confidence. This might involve stricter controls on public spending and more transparent reporting practices.

- Political Consensus Building: Encouraging dialogue among political factions can foster stability, making it essential for leaders to find common ground on fiscal reforms.

- Boosting Economic Growth: Implementing structural reforms aimed at revitalizing key sectors can create resilience against economic volatility. This can be achieved through investments in innovation and technology.

Moreover, an active communication strategy plays a crucial role in mitigating debt concerns. Maintaining an open dialogue with international credibility metrics can also assist in restoring confidence among global investors. To further elaborate on this aspect, the following table summarizes potential investor trust-building activities:

| Activity | Objective |

|---|---|

| Regular Policy Briefings | Keep investors informed and engaged |

| Debt Management Workshops | Educate leaders on best practices |

Future Implications for France’s Global Financial Standing

France’s recent downgrade in its debt rating raises significant concerns regarding its position in the global financial landscape. The cut, driven primarily by apprehensions surrounding political instability, suggests a precarious confidence in the nation’s fiscal integrity and governance. Analysts warn that this could result in increased borrowing costs and diminished trust among international investors, potentially leading to a cycle of economic challenges. In an environment where political unity is paramount, the repercussions may extend beyond immediate financial metrics to influence France’s economic policies and social cohesion.

Looking ahead, the implications of this downgrade could reshape France’s approach to fiscal policy and international negotiations. Key influences may include:

- Investor Sentiment: A decline in foreign investment as international stakeholders reevaluate their risk exposure.

- Policy Revisions: Potential shifts in economic policy as the government attempts to stabilize its credit rating.

- Long-term Growth Factors: Strategies to foster sustainable growth amid rising skepticism about political stability.

These elements point to a crucial period for France as it navigates not only its domestic challenges but also its role in the broader European and global economy.

In Retrospect

In conclusion, France’s recent downgrade in its debt rating underscores the mounting concerns surrounding the nation’s political landscape. As investors and analysts alike assess the potential implications of increased instability, the government faces the dual challenge of restoring confidence in its economic policies while addressing the very issues that have led to this heightened scrutiny. With the upcoming elections and ongoing social unrest, the stakes have never been higher for France as it navigates a critical juncture in its fiscal and political future. Stakeholders across all sectors will be closely monitoring developments, as the fallout from this ratings cut may reverberate well beyond France’s borders, impacting the broader European economy.