June 2025 | Hydrogen in France Business Update – France Hydrogène

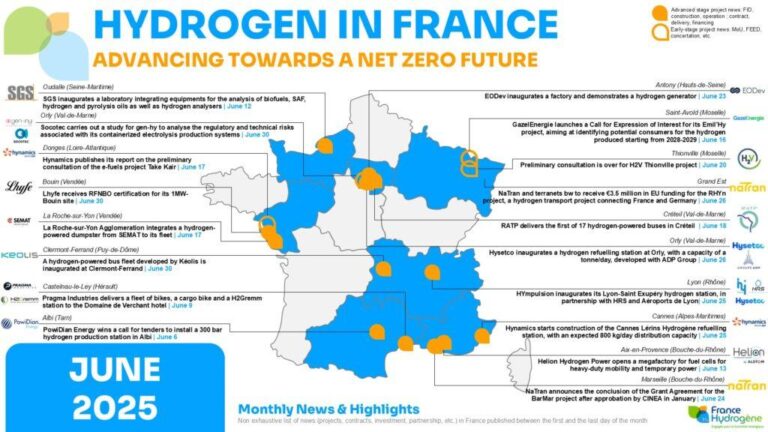

As France positions itself at the forefront of the clean energy transition, hydrogen has emerged as a pivotal component in the nation’s decarbonization strategy. The latest developments in June 2025 highlight significant strides across the French hydrogen sector, marked by ambitious government initiatives, expanding industrial projects, and growing private sector investments. This business update from France Hydrogène offers an in-depth look at the current landscape, key market players, and upcoming opportunities shaping the future of hydrogen in France.

June 2025 France Hydrogen Market Dynamics Show Rapid Expansion

France continues to assert its leadership in the hydrogen sector, with June 2025 marking a period of rapid growth and strategic advancements. The government’s recent policy frameworks and increased funding have accelerated deployment across multiple industries, particularly transportation and heavy manufacturing. Key players in the market are scaling up production capacities, doubling green hydrogen output compared to the previous quarter. This expansion is further supported by an ecosystem fostering innovation, including emerging partnerships between energy companies, startups, and public institutions.

Market highlights include:

- Launch of three new large-scale electrolyzer projects in the Auvergne-RhĂ´ne-Alpes region.

- Significant surge in hydrogen-powered public transport fleets, with over 120 new buses introduced nationwide.

- Integration of hydrogen solutions into industrial clusters aiming for carbon neutrality by 2030.

- Boosted export potential through collaborations with neighboring European countries.

| Segment | Q1 2025 Capacity (MW) | Q2 2025 Capacity (MW) | Growth Rate (%) |

|---|---|---|---|

| Green Hydrogen Production | 150 | 300 | 100% |

| Transport Sector Adoption | 80 | 142 | 77.5% |

| Industrial Usage | 45 | 85 | 88.9% |

Key Players and Strategic Partnerships Shaping the Industry Landscape

France’s hydrogen sector is witnessing robust momentum, driven by a mix of established energy giants and ambitious startups. ENGIE continues to lead in large-scale green hydrogen projects, leveraging its extensive infrastructure and renewable energy assets. Meanwhile, new entrants like Hynamics are scaling up innovative electrolyzer technologies, accelerating the commercial viability of hydrogen solutions. These key players are not only investing heavily in domestic projects but also positioning themselves for greater influence across the European hydrogen value chain.

The landscape is further enriched by strategic partnerships that blend expertise from different industries. Notably, the collaboration between Air Liquide and automotive manufacturers such as Renault exemplifies efforts to develop hydrogen mobility solutions tailored for urban and commercial transport. On the industrial front, alliances between Fives and infrastructure developers are paving the way for optimized hydrogen production and storage facilities. Such synergistic partnerships are crucial in overcoming technological and logistical barriers, fostering a more integrated and competitive hydrogen ecosystem in France.

| Company | Sector Focus | Key Partnership | 2025 Project Highlight |

|---|---|---|---|

| ENGIE | Green Hydrogen Production | EDF Renewables | Gigawatt Electrolyzer in Dunkirk |

| Air Liquide | Hydrogen Supply & Mobility | Renault | Hydrogen Fueling Stations Rollout |

| Hynamics | Electrolyzer Manufacturing | Fives | Advanced PEM Electrolyzer Deployment |

| McPhy | Hydrogen Storage Solutions | Technip Energies | Modular Storage Systems for Industries |

Innovative Projects and Infrastructure Developments Accelerate Adoption

France’s hydrogen sector is witnessing a rapid transformation as cutting-edge projects and infrastructure initiatives come to the forefront. Pioneering public-private collaborations are powering the expansion of green hydrogen production hubs across key regions, aiming to reduce carbon emissions and meet ambitious energy transition targets. Notably, the deployment of large-scale electrolysis plants with capacities exceeding 100 MW marks a significant leap in local production capabilities, positioning France as a European hydrogen leader.

In parallel, a robust network of refueling stations and dedicated hydrogen corridors for transportation is under construction, enhancing fuel accessibility and versatility. These infrastructure investments are critical in driving adoption across multiple industries, including heavy transport and maritime sectors. Key projects currently underway include:

- Hydrogen mobility clusters in the Auvergne-RhĂ´ne-Alpes and Normandy regions

- Industrial decarbonization initiatives integrating hydrogen into steel and chemical manufacturing

- Smart grid integration enabling renewable energy surge management through hydrogen storage

| Project | Region | Capacity (MW) | Status |

|---|---|---|---|

| H2 Vallée | Auvergne-Rhône-Alpes | 150 | Operational 2025 |

| NormandH2 Corridor | Normandy | 80 | Under Construction |

| GreenSteel Integration | Hauts-de-France | 60 | Planning Stage |

Recommendations for Investors to Navigate Regulatory and Market Challenges

Investors venturing into France’s hydrogen sector must prioritize agility and vigilance amidst a dynamic regulatory landscape. To mitigate risks, staying actively engaged with policy updates from both national and European bodies is crucial. Regular consultation with legal and technical experts can clarify compliance complexities and anticipate shifts that influence project viability. Emphasizing partnerships with established local operators and research institutions will also provide strategic insights and shared resources, fostering resilience against regulatory uncertainties.

Market challenges require a balanced approach of diversification and innovation. Allocating capital across various hydrogen applications—such as transport, industrial, and energy-storage solutions—can help cushion against sector-specific downturns. Additionally, investors should advocate for and support pilot projects that integrate emerging technologies and scalable infrastructure, ensuring exposure to cutting-edge advancements. Consider the following strategic imperatives:

- Monitor evolving subsidy and incentive programs to maximize returns and align projects with public funding opportunities.

- Establish flexible investment frameworks that allow quick pivots in response to market shifts or regulatory changes.

- Engage in industry associations like France Hydrogène to access exclusive data and influence policy discussions.

| Key Risk Factor | Recommended Mitigation Strategy | Expected Outcome |

|---|---|---|

| Regulatory delays | Proactive regulatory tracking and legal advisory | Faster project approvals and reduced compliance costs |

| Market volatility | Diversified portfolio across multiple hydrogen segments | Stabilized returns and risk buffering |

| Technological uncertainty | Investment in pilot and demonstration projects | Early access to innovative applications and scalability |

In Summary

As June 2025 draws to a close, the momentum behind hydrogen initiatives in France continues to accelerate, underscoring the nation’s commitment to a clean energy future. With France Hydrogène at the forefront of industry developments, ongoing investments, strategic partnerships, and policy support signal a promising trajectory for hydrogen’s role in decarbonizing the economy. Stakeholders will be watching closely as projects advance from pilot phases to full-scale deployment, shaping not only the French energy landscape but also setting a benchmark for Europe’s green transition. Stay tuned for further updates on this dynamic sector.