Buy Bordeaux, Claim the VAT, Bring It Home: How to Save on Wine Purchases

In a move that could benefit oenophiles and budget-conscious travelers alike, savvy wine lovers are discovering the advantages of purchasing Bordeaux wines directly from France. With its world-renowned vineyards and exquisite vintages, Bordeaux offers more than just a taste of luxury; it presents an opportunity for substantial savings through the VAT (Value Added Tax) refund process. This alluring financial incentive is drawing increasing attention from wine enthusiasts eager to stock their cellars at home while keeping their finances intact. In this article, we explore the ins and outs of claiming VAT on your wine purchases, providing practical tips on how to navigate the process efficiently, ensuring your next Bordeaux shopping trip is both pleasurable and economical. Join us as we unveil the intricacies of this lucrative endeavor, redefining the wine-buying experience for consumers all over the globe.

Maximizing Savings: The Benefits of Purchasing Bordeaux in France

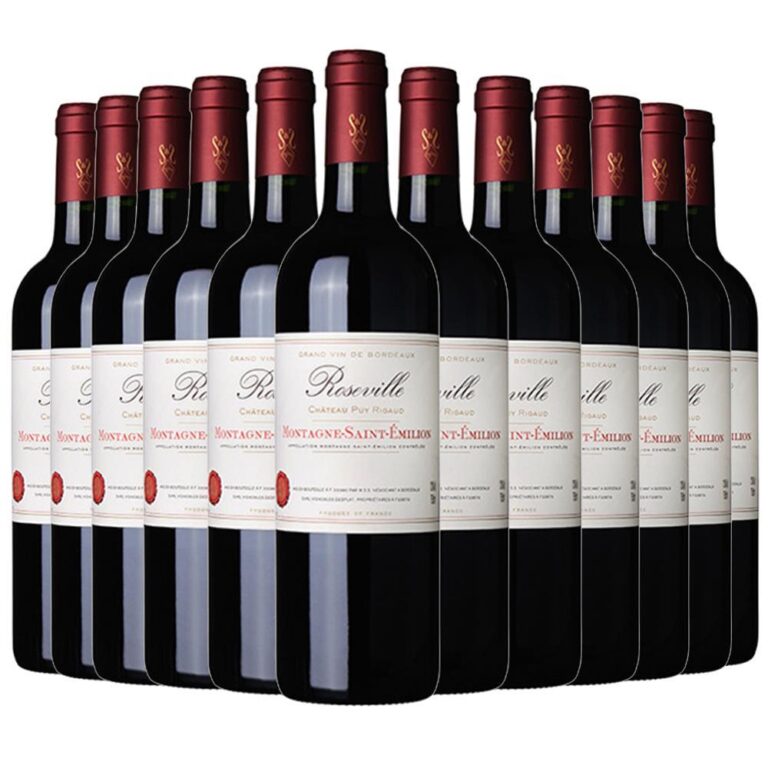

Purchasing Bordeaux directly from the source offers an unparalleled opportunity for wine enthusiasts to explore a diverse range of premium wines while enjoying significant cost savings. The robust wine culture in France ensures that you have access to exclusive vintages, some of which may not be available in your home country. By buying directly in Bordeaux, you also benefit from a considerable reduction in retail markups, enabling you to acquire high-quality wines at competitive prices that are often significantly lower than those found elsewhere.

In addition to the lower purchase price, travelers can take advantage of the Value Added Tax (VAT) refund for non-EU residents, further maximizing savings. The process generally entails simply claiming back the VAT on purchases over a certain amount upon departure. Here’s a streamlined table outlining the benefits of purchasing Bordeaux wine in France:

| Benefit | Description |

|---|---|

| Access to Exclusive Wines | Find rare and local selections not available outside France. |

| Lower Cost | Eliminate retail markups and purchase directly from vineyards. |

| VAT Refund | Claim back the VAT for purchases above the required threshold. |

| Wine Expertise | Gain insights from experts at the vineyards. |

Understanding VAT Refunds: A Step-by-Step Guide for Travelers

When traveling within the EU, taking advantage of VAT refunds on your wine purchases can significantly reduce costs. To claim your VAT refund after buying Bordeaux, follow these straightforward steps to ensure a smooth process. Start by obtaining the proper invoices from the winery or retailer—it’s essential that these include clear details about the wine, the VAT amount, and your identification. Keep in mind, you’ll need to show these invoices when claiming your refund, so store them safely. Once you’ve made your purchases, visit the VAT refund desk at the airport before checking in for your flight. This is the crucial step where you can get your invoices stamped, indicating that you are exporting the goods outside of the EU. Make sure to allow enough time for this process, which can sometimes take longer than expected.

After leaving the VAT refund desk, you’ll have several options for receiving your refund. Most commonly, travelers opt for a cash refund or a credit to their credit card. However, be aware of transaction fees that might apply. Here’s a quick summary of the options you might encounter:

| Refund Method | Pros | Cons |

|---|---|---|

| Cash Refund | Instant payment | May have fees |

| Credit Card Refund | Easy tracking | Long processing time |

In conclusion, understanding these steps not only enhances your travel experience but also allows you to indulge in exquisite Bordeaux wines without breaking the bank. Make sure to stay informed about the regulations surrounding VAT refunds as they can differ by country, ensuring that your wine-savvy shopping spree remains as smooth as the wines you bring home.

Transporting Your Wine: Best Practices for Bringing Bordeaux Home

Transporting your precious Bordeaux requires careful planning to ensure that these exquisite bottles arrive home in perfect condition. When preparing for your journey, consider the following best practices:

- Temperature Control: Maintain a consistent temperature, ideally between 50°F and 60°F (10°C to 15°C), to prevent thermal shock.

- Seek a Proper Carrier: Invest in specialized wine transport bags or hard-shell wine cases for maximum protection.

- Avoid Direct Sunlight: Keep your wine out of direct sunlight during transit to avoid spoilage and color damage.

Additionally, familiarize yourself with the regulations regarding wine transport in your destination country. Some key considerations include:

| Item | Regulation |

|---|---|

| Quantity Limits | Check the legal limits for personal importation. |

| Customs Declaration | Be aware of customs procedures upon arrival. |

| VAT Claim | Ensure you have receipts to successfully claim back VAT. |

Navigating Regulations: What You Need to Know Before You Buy

When considering a wine purchase in Bordeaux, understanding local regulations is crucial for a smooth transaction. VAT exemption can significantly decrease your overall costs, but navigating through the rules can be daunting. Buyers should be aware of the following key points:

- Eligibility Criteria: Ensure you meet the requirements for VAT exemption, which can vary based on your residency status.

- Documentation: Keep all necessary paperwork on hand, including proof of purchase and identification to substantiate your claims.

- Export Limits: Be mindful of any restrictions on how much wine you can bring back home duty-free.

Additionally, it’s vital to plan your logistics carefully to avoid potential fines or losses. Before departing for Bordeaux, consider the following logistical factors:

| Logistical Factor | Details |

|---|---|

| Transportation | Plan for the safest and most economical way to transport your wine. |

| Storage | Ensure appropriate storage conditions to preserve wine quality during your journey. |

| Customs Regulations | Research the specific customs allowances for both departure and arrival countries. |

Final Thoughts

In conclusion, savvy wine enthusiasts can unlock substantial savings through the strategic purchase of Bordeaux wines, thanks to the benefits of claiming VAT refunds. As demonstrated throughout this article, understanding the ins and outs of this process not only enhances your collection but also allows you to enjoy premium French wines without the steep price tag often associated with them. By following the outlined steps and navigating the regulations adeptly, you can transform your wine-buying experience into a financially savvy endeavor. As the allure of Bordeaux continues to captivate palates around the globe, this approach not only supports your passion for wine but also makes it more accessible than ever. Cheers to enjoying fine wine while keeping your budget intact!