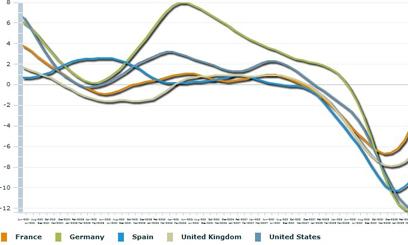

French business sentiment has taken a sharp downturn, signaling a bleak economic outlook according to the latest analysis from ING Think. Recent data reveals growing pessimism among French companies, reflecting mounting challenges that could weigh heavily on the countryŌĆÖs economic recovery. This shift in business confidence comes amid inflationary pressures, supply chain disruptions, and geopolitical uncertainties, raising concerns about the trajectory of FranceŌĆÖs economic performance in the coming months.

French Business Confidence Drops Amid Rising Economic Uncertainties

Recent surveys reveal a marked decline in confidence among French businesses, reflecting growing concern about the nation’s economic trajectory. Companies across sectors are citing inflationary pressures, supply chain disruptions, and geopolitical tensions as key factors undermining their optimism. This shift in sentiment is especially pronounced in manufacturing and export-oriented industries, where uncertainty regarding global demand and cost volatility exacerbate operational challenges.

The following table summarizes key confidence indicators from the April business survey, highlighting the areas facing the steepest declines:

| Sector | Confidence Index (April) | Change from March |

|---|---|---|

| Manufacturing | 92 | -8 |

| Services | 96 | -5 |

| Retail | 89 | -7 |

| Construction | 94 | -4 |

Expert analysis suggests that without a significant easing of inflation and improvements in supply logistics, French firms may continue to adopt a cautious stance towards investment and hiring. Moreover, policymakers face mounting pressure to implement measures that restore economic stability and bolster business confidence amid these turbulent times.

Industrial Sector Faces Declining Orders and Investment Hesitation

Recent reports reveal a notable downturn in industrial activity as manufacturers struggle with waning demand. Orders have diminished sharply, causing many enterprises to adopt a cautious stance on capital expenditures. This hesitation stems from the growing uncertainty about future market conditions, compounded by global supply chain disruptions and elevated energy costs. Key industries such as automotive, machinery, and chemicals are particularly affected, with production schedules being scaled back and new projects postponed indefinitely.

Critical factors influencing this trend include:

- Declining export volumes amid weaker international demand

- Unstable raw material prices affecting budgeting and procurement

- Rising interest rates leading to increased borrowing costs

- Regulatory pressures and environmental compliance expenses

| Industry | Order Decline (YoY %) | Investment Change (Past Quarter) |

|---|---|---|

| Automotive | -18% | -12% |

| Machinery | -15% | -9% |

| Chemicals | -10% | -7% |

Consumer Spending Weakness Challenges Growth Prospects

Recent data highlights a notable decline in household expenditures, striking a blow to FranceŌĆÖs delicate economic recovery. With inflationary pressures persisting, consumers are increasingly prioritizing essentials, resulting in subdued demand across multiple sectors. Retail and discretionary spending have borne the brunt, further dampening business confidence and casting doubt over near-term growth trajectories.

Key factors contributing to this softness include:

- Rising living costs squeezing disposable incomes

- Heightened uncertainty around employment stability

- Elevated interest rates curtailing household borrowing

These headwinds are reflected in the latest consumer sentiment indices, which reveal a cautious populace less willing to engage in larger purchases. The combined effect risks creating a feedback loop, where subdued spending limits business investment and hiring, reinforcing the broader economic slowdown.

| Sector | Q1 Consumer Spending Change (%) | Impact on Business Sentiment |

|---|---|---|

| Retail | -3.2 | Negative |

| Automotive | -4.5 | Negative |

| Hospitality | -1.8 | Neutral |

Policy Recommendations Focus on Boosting Innovation and Fiscal Support

To counteract the dwindling business confidence in France, experts emphasize the imperative need for a dual approach targeting both innovation and fiscal policies. Enhancing R&D incentives can stimulate breakthrough technologies, providing companies critical levers to navigate current economic headwinds. This includes expanding tax credits for research activities and fostering stronger public-private partnerships to accelerate commercialization of cutting-edge solutions.

Simultaneously, there is a call for recalibrated fiscal support measures aimed at cushioning enterprises against immediate financial shocks while sustaining long-term growth potential. Proposed actions range from temporary subsidies for energy costs to streamlined access to capital for small and medium-sized enterprises (SMEs). The table below highlights key recommended policy interventions designed to bolster the business landscape:

| Policy Area | Key Measures | Expected Impact |

|---|---|---|

| Innovation |

| Boosts competitiveness and tech adoption |

| Fiscal Support |

| Mitigates short-term risks and sustains growth |

In Conclusion

As the latest ING Think report reveals a marked decline in French business sentiment, economic uncertainties appear set to weigh heavily on FranceŌĆÖs financial landscape in the months ahead. With key sectors expressing growing concern, policymakers and market watchers will be closely monitoring developments to gauge the potential impact on growth and investment. This sobering outlook underscores the challenges facing the French economy as it navigates a complex global environment.