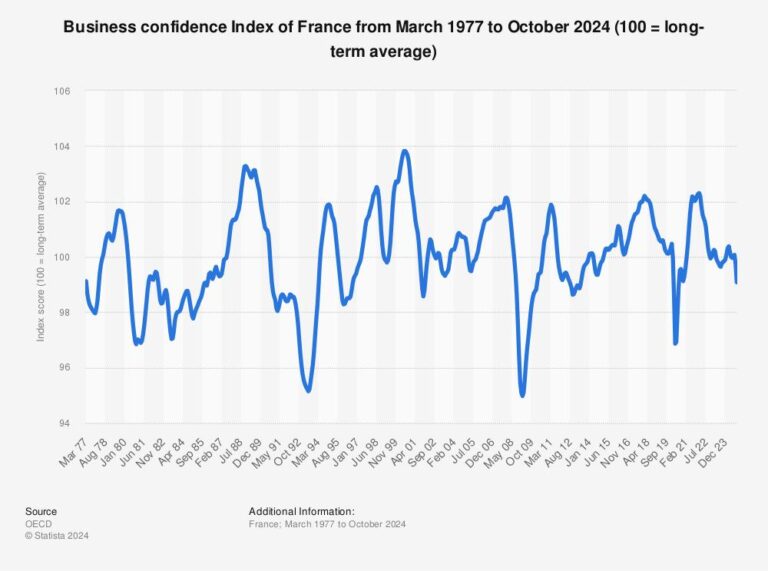

France’s business confidence index remained stable in the latest survey, signaling cautious optimism among companies as the economy navigates persistent global uncertainties. Market participants are now closely monitoring how investors and policymakers will react to this steady sentiment, with implications for France’s economic outlook and the broader European market. This article delves into the latest data from TipRanks, analyzing the factors behind the consistent business confidence and what lies ahead for the French economy.

France’s Business Confidence Index Shows Stability Amid Economic Challenges

Despite ongoing economic headwinds marked by fluctuating consumer demand and geopolitical tensions, the latest metrics indicate that the business confidence within France remains notably resilient. Companies across various sectors are maintaining a cautiously optimistic outlook, buoyed by steady production levels and sustained consumer engagement. Analysts attribute this steadiness to adaptive strategies implemented by businesses, including increased digital integration and diversified supply chains.

The market is currently absorbing these stable signals amid broader uncertainty, with investors closely monitoring upcoming fiscal policies and international trade developments. Key factors influencing this equilibrium include:

- Employment rates holding firm despite inflationary pressures

- Manufacturing output showing minor improvements

- Consumer spending trends remaining stable

- Government interventions aimed at economic support

| Sector | Confidence Level (Index) | Change from Previous Month |

|---|---|---|

| Manufacturing | 105 | +1 |

| Services | 98 | 0 |

| Retail | 94 | -1 |

| Construction | 102 | +2 |

Analysts Weigh In on Sectoral Performance and Growth Prospects

Market analysts emphasize that France’s business confidence index reflects a cautious yet stable outlook across key sectors. Despite global uncertainties, several industries demonstrated resilience, with manufacturing and services sectors showing particularly steady sentiment. Experts highlight that the steady confidence levels suggest firms are bracing for moderate growth, balancing optimism with prevailing economic headwinds.

Detailed sectoral analysis reveals nuanced growth prospects:

- Manufacturing: Mixed signals but overall positive momentum driven by export demand.

- Retail: Stable consumer spending supports steady performance, though inflation remains a concern.

- Technology: Continued innovation fuels cautious optimism despite broader market volatility.

| Sector | Confidence Change | Growth Forecast |

|---|---|---|

| Manufacturing | +1.2% | 2.5% YoY |

| Retail | 0% | 1.8% YoY |

| Technology | +0.8% | 3.1% YoY |

Investor Sentiment Mixed as Markets Eye Upcoming Policy Announcements

Investor sentiment remains divided as key markets anticipate upcoming policy announcements that could recalibrate economic outlooks globally. While France’s business confidence index maintained its steady pace this month, market participants are cautiously weighing the implications of central bank statements and government fiscal measures expected in the coming sessions. The blend of stable domestic indicators and potential external shocks has resulted in a cautious trading environment, with investors balancing optimism against the unpredictability of policy shifts.

Market watchers highlight several critical factors influencing current sentiment:

- Monetary Policy Signals: Central banks’ tone on interest rates and inflation controls is a primary driver.

- Fiscal Stimulus Outlook: Expectations of new government spending programs or austerity measures are under scrutiny.

- Geopolitical Developments: Ongoing tensions and trade negotiations continue to inject uncertainty.

| Indicator | Current Value | Previous Month | Market Impact |

|---|---|---|---|

| Business Confidence (France) | 101.5 | 101.3 | Neutral |

| Inflation Rate (Eurozone) | 5.2% | 5.4% | Cautious |

| ECB Policy Rate | 3.5% | 3.0% | Watchful |

Strategic Recommendations for Navigating Uncertainty in the French Economy

In the wake of persistent economic fluctuations, businesses in France are urged to adopt a resilient and adaptive approach. Prioritizing diversification of supply chains can mitigate risks associated with geopolitical tensions and logistic disruptions. Companies should also leverage data-driven analytics to monitor shifting consumer behaviors and anticipate market adjustments. Emphasizing innovation and digital transformation will not only enhance operational efficiency but also ensure competitiveness amid evolving economic landscapes.

Furthermore, fostering strong relations with financial institutions is critical for securing flexible funding options. Strategic cash flow management must remain a core focus to withstand potential liquidity pressures. Key recommendations include:

- Enhancing talent agility: Upskilling and cross-training employees to meet dynamic demands.

- Scenario planning: Developing contingency strategies to prepare for economic variability.

- Strengthening stakeholder communication: Maintaining transparency with investors and partners.

These targeted measures provide a roadmap to navigate uncertainty while positioning French businesses for sustained growth.

In Conclusion

As France’s business confidence remains steady, market participants continue to monitor upcoming economic indicators and policy announcements for further direction. Investors and analysts alike will be closely watching how these factors influence market sentiment in the weeks ahead, seeking clarity amid ongoing global uncertainties.