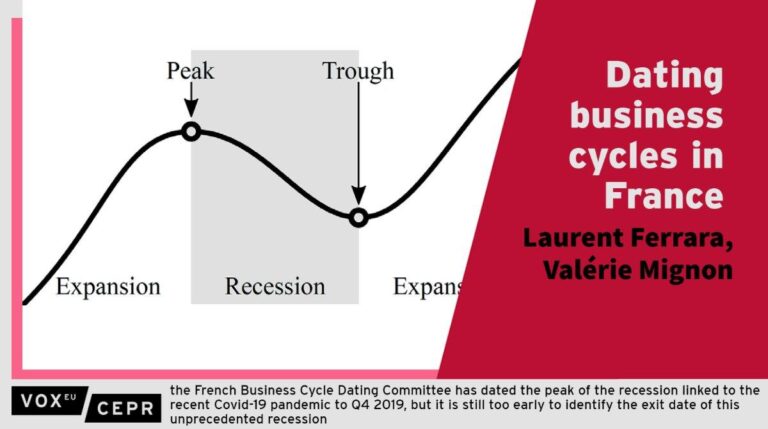

In a new guest contribution featured on Econbrowser, the complex interplay between the business cycle and economic policy uncertainty in France takes center stage. As global markets grapple with persistent volatility, understanding how France’s economic fluctuations respond to policy-related uncertainties has become increasingly crucial. This insightful analysis delves into the nuances of French economic dynamics, shedding light on the implications for policymakers, investors, and the broader economic landscape.

Understanding the Impact of Economic Policy Uncertainty on France’s Business Cycle

Economic policy uncertainty has increasingly become a significant driver of fluctuations in the French business cycle. When policymakers signal unpredictability around fiscal or regulatory measures, businesses tend to adopt a more cautious stance—delaying investments and hiring decisions. This hesitation dampens economic momentum, often triggering slower GDP growth and increased volatility in employment figures. Key sources of uncertainty include shifting taxation policies, changing labor regulations, and the potential impact of EU-wide reforms. These uncertainties do not affect all sectors equally; manufacturing and export-driven industries, for instance, experience more pronounced effects due to their sensitivity to global market confidence.

Recent empirical analyses reveal a strong correlation between spikes in economic policy uncertainty and downturns in industrial output and consumer spending. The following list highlights the primary channels through which uncertainty influences the economy:

- Investment postponement: Firms delay capital expenditure amid unclear policy frameworks.

- Credit tightening: Banks become more risk-averse when policy direction is uncertain, constraining business financing.

- Consumer caution: Households reduce discretionary spending due to concerns about future economic conditions.

- Labor market effects: Hiring slows down, affecting wage growth and unemployment rates.

| Economic Indicator | Effect of High Policy Uncertainty | Typical Impact Duration |

|---|---|---|

| GDP Growth Rate | Decline of 0.5% to 1.0% | 6-12 Months |

| Industrial Production | Slowdown by 3-5% | 3-6 Months |

| Business Investment | Reduction around 7% | 6-9 Months |

| Unemployment Rate | Increase of 0.2-0.4 Percentage Points | 9-12 Months |

Analyzing Recent Trends and Fluctuations in French Economic Activity

Recent months have spotlighted a dynamic interplay between economic activity and policy uncertainty in France, revealing nuanced shifts within key sectors. Industrial output, although rebounding from last year’s downturn, continues to face headwinds stemming from fluctuating global demand and supply chain disruptions. Meanwhile, consumer spending exhibits resilience supported by easing inflationary pressures, yet remains cautiously moderated by households’ expectations about future fiscal policies. Noteworthy is the divergence between regional performances: ĂŽle-de-France and Auvergne-RhĂ´ne-Alpes are spearheading growth, in contrast to slower recoveries in traditionally industrial areas.

Policy uncertainty has emerged as a pivotal factor clouding the economic outlook, with businesses adjusting investment plans amid legislative changes and geopolitical tensions. Key indicators reflect this volatility:

- Business Confidence Index: Fluctuated within a narrow range, reflecting mixed sentiment across industries

- Unemployment Rate: Stability at 7.1%, with slight improvements in service-oriented sectors

- Inflation Trends: Downward trajectory easing pressure on real incomes but prompting cautious monetary stance

| Quarter | GDP Growth (%) | Policy Uncertainty Index (Scale 1-100) |

|---|---|---|

| Q1 2024 | 0.3 | 65 |

| Q2 2024 | 0.5 | 58 |

These trends signal that while the French economy navigates gradual recovery, managing policy uncertainty remains crucial to sustaining momentum and fortifying business confidence moving forward.

Policy Measures to Mitigate Uncertainty and Stabilize Growth

Addressing economic uncertainty requires a multifaceted approach, combining fiscal, monetary, and regulatory policies tailored to France’s unique economic landscape. Governments can play a pivotal role by implementing counter-cyclical fiscal measures such as targeted stimulus packages and public investment programs aimed at cushioning the adverse effects of downturns. Additionally, transparency in policy decisions and clear communication strategies help reduce market volatility by setting well-defined expectations for businesses and consumers.

Monetary policy must also remain flexible and responsive, with central banks poised to adjust interest rates and deploy unconventional tools when necessary. Structural reforms that enhance labor market flexibility and innovation capacity can foster resilience. Key strategies include:

- Automatic stabilizers: Strengthening social safety nets to support income during economic slowdowns.

- Regulatory oversight: Enhancing financial sector supervision to prevent systemic risks.

- Investment in technology: Promoting digital transformation to stimulate productivity.

| Policy Measure | Primary Objective | Expected Impact |

|---|---|---|

| Counter-cyclical fiscal spending | Stimulate demand during recessions | Short-term growth stabilization |

| Transparent policymaking | Reduce uncertainty | Improved business investment |

| Labor market reforms | Increase flexibility | Enhanced employment stability |

Recommendations for Strengthening France’s Economic Resilience

To enhance economic resilience, France must prioritize diversification of its industrial base by investing in emerging technologies such as renewable energy, artificial intelligence, and biotechnology. Strengthening local supply chains and fostering innovation hubs outside of traditional metropolitan centers can reduce vulnerability to global shocks. Policymakers should also focus on improving labor market flexibility while maintaining strong social protections, facilitating smoother transitions during economic downturns without sacrificing worker welfare.

- Encourage public-private partnerships in R&D to accelerate technological adoption

- Expand vocational training programs aligned with future job market demands

- Implement targeted fiscal policies to stabilize demand during uncertain periods

- Enhance digital infrastructure to support business continuity and remote work

Moreover, transparency in economic policymaking must be improved to reduce uncertainty. Clear communication strategies backed by timely and reliable data will help businesses and investors make informed decisions. Regulatory frameworks should be adaptable yet predictable, balancing oversight with entrepreneurial freedom. France’s resilience will ultimately depend on its ability to create an environment where innovation thrives amid volatility, ensuring sustainable growth in the face of global economic challenges.

The Conclusion

In sum, the guest contribution on “The Business Cycle and Economic Policy Uncertainty in France” offers valuable insights into the complex interplay between economic fluctuations and policy unpredictability. As France continues to navigate a challenging economic landscape, understanding these dynamics is crucial for policymakers, businesses, and analysts alike. Stay tuned to Econbrowser for further expert analyses and in-depth coverage on how economic policy uncertainty shapes broader economic trends both in France and beyond.